AMD's Stock Price Surges Beyond NVIDIA, Requiring a "Perfect" Earnings Report to Satisfy the Market

Zhitong Caijing APP has learned that AMD (AMD.US) will announce its second-quarter earnings after the US market closes on Tuesday. The company's earnings report is expected to show how this chipmaker is benefiting from the competitive landscape in the artificial intelligence (AI) field, but whether this growth is sustainable remains a question. After all, its stock price has surged by 46% since 2025.

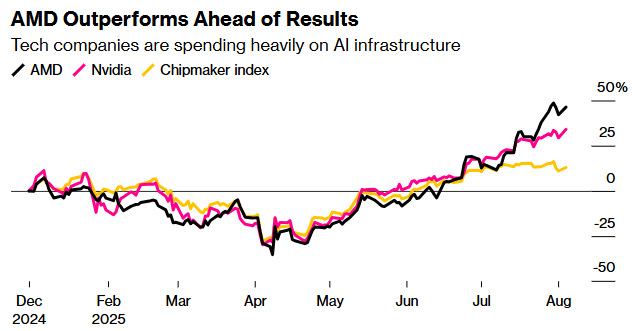

AMD is one of the most outstanding chipmakers, with its stock price rising 34% year-to-date. As companies continue to invest in AI computing equipment, AMD's performance is becoming increasingly evident. In the market for accelerators used to run and develop AI services, NVIDIA (NVDA.US) holds a dominant position, with its stock price also rising by 46%. Compared to its larger competitors, AMD's outstanding performance indicates that investors have high expectations for it.

According to Matt Wittmer, investment manager at Allspring Global Investments: "For AMD, the key to maintaining its growth momentum is to understand its positioning in the AI infrastructure. The stock has performed well recently, but valuations may be a bit stretched. However, from a long-term perspective, as the entire AI industry continues to grow, it still has room for growth."

This year, semiconductor stocks have performed strongly due to the accelerated expansion of AI computing capabilities. The Philadelphia Semiconductor Index has risen by 13%, surpassing the Nasdaq 100 index's 10% gain. Over the past two weeks, Meta (META.US), Microsoft (MSFT.US), Amazon (AMZN.US), and Alphabet (GOOGL.US) have all announced ambitious spending plans, with a total investment of over $34 billion this year, mostly in AI-related expenditures.

Estimates suggest that NVIDIA's revenue share in the GPU market is around 95%, with products performing exceptionally well in AI computing. Although AMD is developing rapidly, it only accounts for about 5% of the market. According to analysts' predictions, AMD's second-quarter revenue is expected to reach $7.4 billion, a year-over-year growth rate of 27%.

However, simply meeting Wall Street's expectations may not be enough to satisfy investors. Last week, Arm Holdings (ARM.US) experienced its largest decline this year, despite matching analysts' average predictions for the current quarter. Similarly, Qualcomm (QCOM.US) saw its stock price drop by 7.7% after announcing a quarterly sales forecast range.

Aside from AI-related investments, AMD is also benefiting from its increasing market share in the central processing unit (CPU) market, which is achieved by nibbling at Intel's (INTC.US) market share. Intel is working hard to regain its technological leadership position. Furthermore, AMD is expected to benefit from plans to resume sales of some AI chips in China after obtaining US government approval.

However, the current focus remains on AI opportunities. According to Ulrike Hoffmann-Burchardi, Chief Investment Officer at Goldman Sachs' Americas and Global Equities: "By 2026, global AI expenditures are expected to reach $50 billion, a year-over-year growth rate of nearly one-third. She wrote in her report published on July 31: 'The strong AI investment trend will continue to support the profitability growth of the technology industry. The semiconductor industry will remain the fastest-growing sector.'

According to predictions, NVIDIA's revenue growth rate is expected to reach 53% when it announces its second-quarter earnings on August 27, which is twice AMD's growth rate. However, NVIDIA's stock valuation is similar to AMD's, at around 35 times future earnings expectations.

The difficulty of competing with NVIDIA is an important reason why Wall Street has a more cautious outlook for AMD's development prospects. According to analyst data, only about 70% of analysts recommend buying AMD stock, compared to nearly 90% for NVIDIA. Given that AMD's trading price is 15% above the average target price, according to analysts' predictions, the company's potential return on investment in the Philadelphia Semiconductor Index is the worst.

Randy Hare, Head of Stock Strategy at Huntington National Bank, still favors NVIDIA over AMD due to its stronger growth performance. However, he notes that both companies have the potential to continue outperforming the market. He says: "Investors are gradually realizing that this market is large enough to accommodate more than one 'fish' (i.e., more than one company)."