America's "Dead Cat Bounce"? DoubleLine Capital: May Trigger a Sharp Devaluation, Kickstarting a "Multi-Year Downtrend"

Zhitong Caiping APP has learned that, according to Bill Campbell, investment portfolio manager at DoubleLine Capital, the US dollar may continue to plummet further, and even if the new Chairman of the Federal Reserve takes swift action to lower interest rates, this could become a catalyst for the dollar's decline. In an interview, Campbell stated, "The US dollar still has more room for decline." As of September 2024, DoubleLine Capital Management's assets under management reached $950 billion.

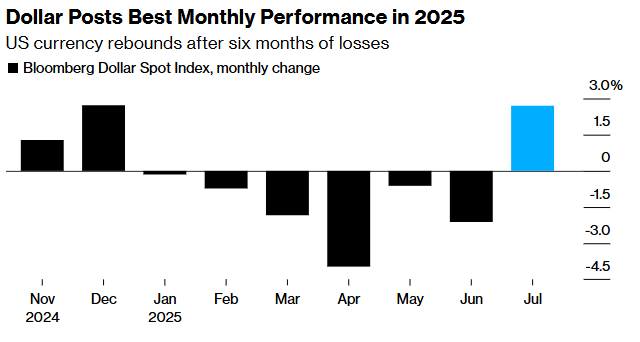

After experiencing its worst year-to-date performance in history, the US dollar saw a 1% monthly gain in July, marking its first rise since 2025. However, Campbell remains steadfast in his opinion that the dollar has entered a multi-year downtrend due to investors' concerns over the massive US fiscal deficit and their subsequent shift of investment towards other regions.

A major unfavorable factor for the dollar is US President Trump's efforts to lower borrowing costs. Trump has repeatedly criticized Federal Reserve Chairman Powell, which is part of an unprecedented public pressure campaign that raises questions about the independence of central banks.

Trump stated that he will announce a new appointment to the Federal Reserve within the next few days to replace Adriana Kugler's position. Adriana Kugler announced her resignation on Friday. Her departure provides Trump with an opportunity to appoint someone who shares his stance on reducing interest rates, which may align more closely with the views of the nominee for the Chairman position.

Campbell believes that the sluggish state of the US economy may also put pressure on the dollar. Last week's data showed that the labor market situation was much worse than expected, and the Fed's preferred inflation indicator rose in June. Economic growth slowing down will make it harder for the government to correct its fiscal direction.

Campbell has taken advantage of the dollar's recent stability by preparing further depreciation and increasing investments in non-dollar bonds in emerging and developed markets. On Tuesday, the Bloomberg Dollar Spot Index rose 0.2%. However, the index has fallen 0.7% since the end of last month and has dropped over 7% this year.

Campbell said that his theory faces its greatest threat from a possible repeat of "exceptionalism" policies in the US. If fiscal policy gets adjusted, trade policy becomes more clear, and economic growth is boosted, such a scenario may occur and support demand for US assets.

This investment portfolio manager is also closely watching commitments made by trade partners (including the EU and Japan) to invest tens of billions of dollars in the US. These investments could offset other funds' outflows. However, the nature and timing of these investments remain unclear.

He said, "I'm taking a wait-and-see approach for this matter. Besides trade agreements, I think global savings will flow back to the US at a slower pace than we've seen in the past."