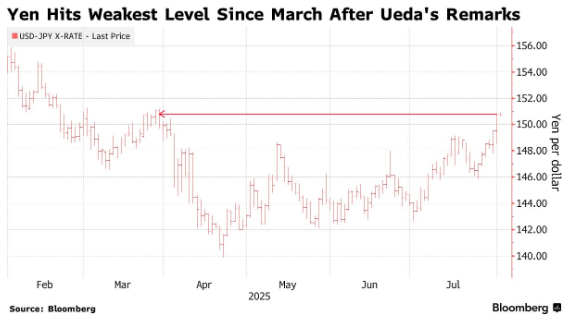

BoJ's Dovish Stance Crushes Yen, Breaks Below 150; Finance Minister Warns of Intervention Possibility

Zhitong Caijing APP has learned that Japanese Finance Minister Shunichi Suzuki expressed concerns over the yen's trend. Following the Bank of Japan's (BoJ) release of dovish rate signals, the yen has fallen to its lowest level since March. Before making his statement, the yen broke below 150 against the US dollar on Thursday. Prior to this, the BoJ had decided to maintain its interest rates unchanged, and Governor Haruhiko Kuroda signaled a dovish stance at a press conference afterwards, extinguishing market expectations of near-term monetary tightening.

Suzuki made his statement before the yen's plunge below 150 against the US dollar. Previously, the BoJ had decided to maintain its interest rates unchanged, and Governor Haruhiko Kuroda signaled a dovish stance at a press conference afterwards, releasing a clear dovish signal that dampened market expectations of near-term monetary tightening.

A Tokyo-based strategist warned that the yen could further depreciate to 155 per dollar, which would trigger investors' caution over potential intervention by the Japanese authorities. "If the BoJ doesn't raise interest rates, the yen may fall to 155," said Marito Ueda, head of market research at SBI Liquidity.

Despite Suzuki's lack of specific comments on the yen's level, he acknowledged that he had taken note of various market views. As of the release date, the yen was trading at around 150.46 against the US dollar.

The yen fell about 4.5% in July, breaking its seasonal trend. Domestic political uncertainty and tariff issues weighed on the yen. Just before the BoJ's decision, traders had also lowered their expectations of a Fed rate cut, further adding to the pressure on the yen.

"Kuroda's stance is still quite dovish, so I think the probability of the yen breaking above 155 is higher," said Tohru Sasaki, chief strategist at Fukuoka Financial Group. "I also don't think the Fed will cut rates this year if expectations continue to fade; the dollar will be sought after instead."

Bloomberg strategist Mark Cranfield believes that combining this week's Fed and BoJ statements with changes in yield curves, dollar-yen traders will focus on a potential intervention zone around 155, rather than the current price level.

This is consistent with Japan's traditional experience-based rule: when the yen moves rapidly by 10 points, verbal intervention should be used first, followed by actual buying of yen if necessary. Last week, the yen briefly fell to around 145, implying that "volatility timing" may have been reset, and thus producing a 10-point movement expectation zone.

"Strong US economic data and a strengthening dollar will push up the dollar-yen rate; if it breaks above 152, the next target will be 155," said Shoki Omori, head of transaction strategy at Sumitomo Mitsui Banking Corporation in Tokyo.

In addition, Suzuki pointed out that Japan's recent trade agreements with the EU and US have helped reduce trade policy uncertainty, lowering its impact on Japanese and global economies. On Thursday, the White House issued an executive order setting the tariff rate for Japanese goods to 15%, implementing the agreement reached earlier between the two countries. The new tax rate will take effect on August 7.

However, Suzuki emphasized that it is still necessary to continue monitoring the impact of the new tax rate. He said, "The Japanese government will take all necessary measures to mitigate the impact of tariffs on Japan's industries and employment," "We will also combine a series of trade agreements and other countries' policy dynamics to fully analyze the impact of tariffs on Japan."