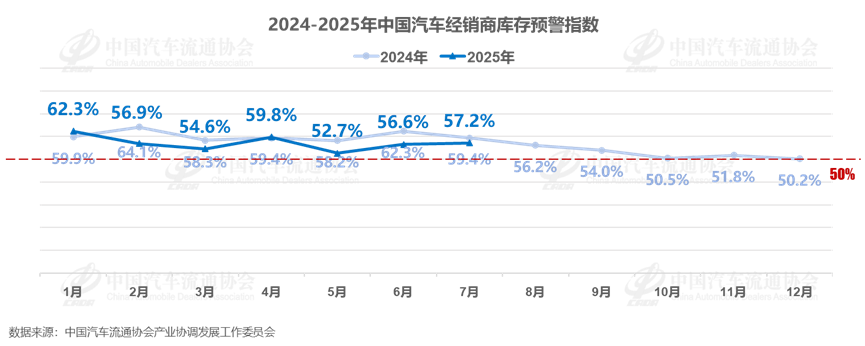

China Automobile Dealers Association: China Automobile Sales Inventory Warning Index for July 2025 is 57.2%

According to our sources, on July 31st, the China Automobile Dealers Association released its latest issue of the "China Automobile Sales Inventory Warning Index Survey", showing that the China automobile sales inventory warning index for July 2025 was 57.2%, a decrease of 2.2 percentage points compared to last year and an increase of 0.6 percentage points compared to the previous month. The inventory warning index is above the neutral line, indicating that the automotive logistics industry's sentiment has decreased slightly.

In July, the automotive market entered its traditional low season. Due to partial regional subsidies being phased out, automobile consumption financial returns being reduced, and manufacturers' promotional efforts being scaled back, consumer sentiment has become more cautious. Feedback from dealers shows that the overall market trend for July is down, with 47.7% of dealers believing that the market will continue to decline in August, with a decrease of over 5%. Although there was some inventory build-up earlier this year, it did not have a significant impact on demand in July. However, effective digestion of early orders and the summer vacation season driving sales, the market's momentum still remains relatively high.

Recently, extreme weather events have been frequent, adding to the pressure on dealerships, which had previously reduced their inventory levels after a busy June. As a result, dealers' inventory levels have shown a slight decline compared to the end of June. In summary, July's passenger car sales were slightly higher than expected, with estimated terminal sales of around 1.9 million units.

Dealers are currently facing the following challenges: terminal customer traffic is declining, consumers are influenced by market conditions and policy adjustments, leading to longer decision-making cycles for car purchases, resulting in lower transaction rates. Meanwhile, inventory turnover has slowed down, putting pressure on cash flow, reducing new car sales margins, and increasing the operating pressure on dealerships.

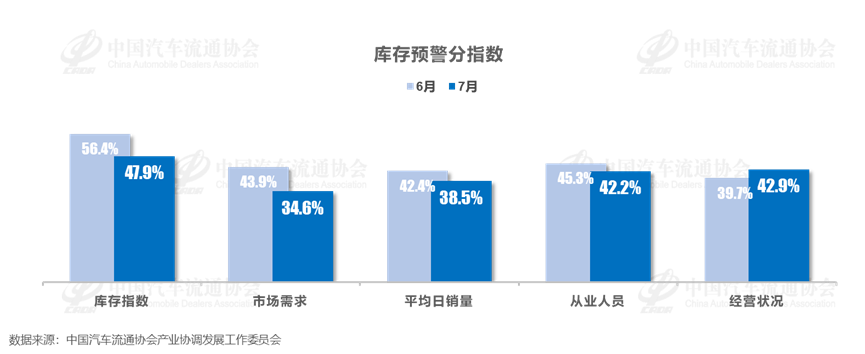

From Index Data: In July, the inventory, market demand, average daily sales, and employee index all decreased compared to last month, while the operating conditions index increased.

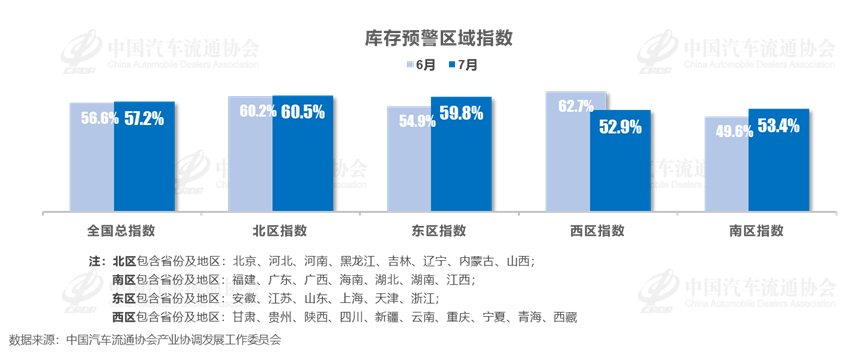

From Regional Index Data: In July, the overall index for all regions was 57.2%, with the North region at 60.5%, the East region at 59.8%, the West region at 52.9%, and the South region at 53.4%.

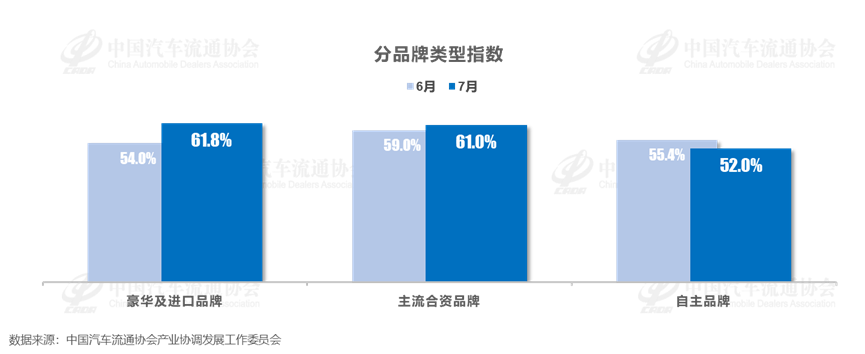

From Index Data by Brand Type: In July, the luxury and imported brand index increased compared to last month, while the self-owned brand index decreased.

Forecast for Next Month's Market: The overall market trend in August is expected to be stable. Although the weather and floods at the end of July may have had a short-term impact on consumer demand, as the school season begins to pick up, sales will gradually recover. Additionally, the 818 car-buying festival promotional activities will also contribute to an increase in terminal sales. It's worth noting that the National Development and Reform Commission, Ministry of Finance, etc. have already issued the third batch of 690 billion yuan of national subsidies on July 26th, continuing to support local implementation of consumer goods replacement policies. The fourth batch is expected to be released in October. In summary, it is estimated that August's overall market performance will be better than July's.

China Automobile Dealers Association recommends that dealers should adjust their expectations based on actual market conditions and emphasize the promotion of "old-for-new" and "scrappage renewal policies". By strengthening services and boosting consumer confidence, they can reduce costs and increase efficiency while avoiding operating risks.