CVS Health (US) Q2 Earnings Surpass Expectations

Zhitong Caijing APP learned that CVS Health (US) released its second-quarter earnings and revenue, both of which exceeded market expectations, and raised its full-year adjusted earnings guidance, mainly due to the strong performance of its retail pharmacy business and the improvement in insurance business. The stock price rose over 9% before trading hours.

The financial report shows that the company's Q2 revenue reached $989.2 billion, up 8.4% year-on-year, exceeding market expectations of $945 billion, thanks to the growth of three major business segments. Net income was $10.2 billion (adjusted EPS $0.80 per share), lower than last year's same period's $17.7 billion (EPS $1.41 per share) due to non-operating assets and restructuring costs. However, after excluding these items, adjusted EPS reached $1.81 per share, exceeding market expectations of $1.46 per share.

Looking ahead, the company currently expects its full-year adjusted EPS to be in the range of $6.30 to $6.40 per share, a significant increase from the previous guidance range of $6.00 to $6.20 per share. The company also lowered its GAAP earnings guidance and did not provide specific reasons.

CVS Health CEO David Joyner attributed the above-mentioned results to the successful transformation of its insurance subsidiary Aetna, particularly highlighting Aetna's "multi-year recovery plan", which is facing challenges similar to those faced by other private health insurance companies in the face of rising medical costs.

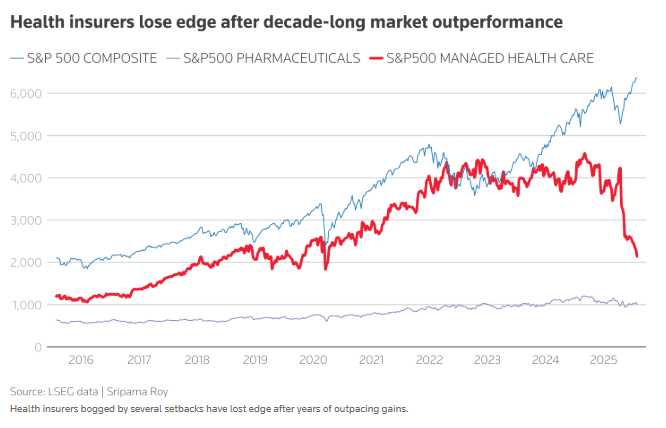

This year, many large healthcare insurance companies have been hit hard due to rising costs and have had to adjust or withdraw their financial guidance. CVS Health previously also faced similar issues: in 2024, it withdrew its earnings guidance due to rising medical costs and reduced government subsidies. Joyner pointed out that the company's progress may be ahead of market expectations by one year.

Joyner also emphasized the strong performance of retail pharmacy business, highlighting the company's efforts to optimize store operations, pricing, and forecasting systems to ensure business management returns to normal.

Furthermore, Joyner noted that the company's retail pharmacy business has "performed exceptionally well", showcasing the company's efforts to optimize store operations and pricing through innovative technologies. He also highlighted the company's investments in human resources and its innovative prescription pricing model, which not only benefits payors but also makes it stand out in the industry.

As part of its transformation plan, CVS Health is expected to reduce costs by $20 billion over the next few years. Joyner noted that achieving this goal will require closing some stores, but the company will also "optimize regional layout", such as expanding coverage in low-density areas like the Pacific Northwest.

Insurance business faces significant pressure

Although all three major business segments exceeded expectations, the insurance department still faced pressure.

In the past year, due to more Medicare Advantage participants returning to hospitals for delayed medical procedures during the pandemic, Aetna and other insurers have similarly experienced a rise in medical costs. The insurance department's medical loss ratio (the percentage of total medical expenses paid by the company) increased from last year's same period's 89.6% to 89.9%. Typically, a lower loss ratio indicates that the company is collecting more premiums than it is paying out in claims, making its profitability stronger.

Notably, the 4.71 billion dollar "premium deficiency reserve" set aside for expected losses in 2025's underwriting year pushed up this ratio. This reserve represents a potential liability if future premiums are insufficient to cover expected payouts and expenses.

Joyner explained that the costs of this business have grown faster than the company's premium income." He also pointed out that these insurance plans are renegotiated every three years, with over 50% of them completing price updates by the end of 2025.

However, actual data still fell short of analysts' expectations at 89.9%, with the department's Q2 revenue reaching $362.6 billion, up over 11% year-on-year, exceeding expectations of $345.9 billion.

Other business aspects include pharmacy and healthcare services sales of $335.8 billion, up over 12% year-on-year, mainly due to growth in pharmacy and front-end store traffic, but partially offset by prescription reimbursement pressure. The department provides prescription filling, vaccine administration, and diagnostic testing services at over 9,000 CVS retail stores.

Joyner noted that the pending acquisition of Rite Aid's part-store data will inject dynamism into business growth. However, in the remaining time this year, vaccine-related business will become a key variable for pharmacy department operations.

"Especially with COVID-19 vaccines, recent dynamics and media reports have been very intense," he explained. Although the company is proceeding with normal vaccination schedules, he emphasized that actual situations may involve uncertainty.

For large retail pharmacies, vaccines typically represent high-profit business. To boost vaccination rates, CVS Health has launched employee incentive programs. However, the company's spokesperson declined to comment on current public willingness to get vaccinated. Notably, after Dr. Robert Kennedy Jr. raised concerns about the safety and effectiveness of some vaccines under his leadership at the US Department of Health and Human Services, the latest CDC guidelines no longer recommend healthy children receive COVID-19 vaccines.

Thanks to pharmacy structure optimization and existing customer retention plans, healthcare services department (including one of the largest pharmacy benefit management companies in the US, Caremark) generated revenue of $464.5 billion, up over 10% year-on-year, exceeding market expectations of $433.7 billion.

As of Wednesday's closing price, CVS Health's stock price has risen by 39% so far this year.