Dangerous Signals Behind US Stock Market's 10th Record High in July: Corporate Executives Suddenly Sell Their Company Stocks

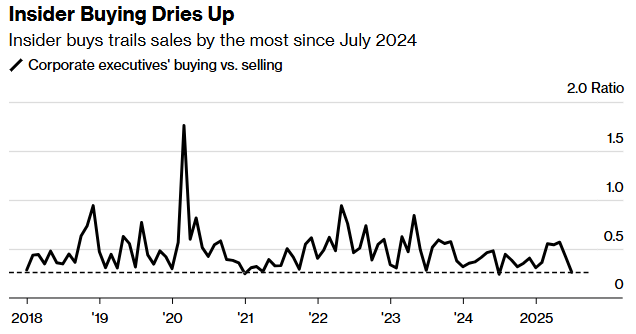

According to Zhitong Caijing APP, investors flocked to the US stock market in July, causing the S&P 500 index to record its 10th historical high in a month. However, an important group has been moving in the opposite direction: corporate executives. According to Washington Service data, only 151 companies among the S&P 500 constituents saw insiders buy company stocks last month, which is the lowest level since at least 2018.

The executives' preference for selling has been declining at a time when the stock market seems to be gradually losing momentum. In fact, this behavior started before Friday's sell-off. After experiencing 6% growth in June and 6.2% growth in May, the S&P 500 index rose by 2.2% in July.

However, this three-month rally has pushed the S&P 500 index to a valuation that is nearly 23 times higher than its average value over the past decade (around 18 times). This phenomenon may indicate that corporate leaders are worried about their own market valuations and concerned about the negative impact of President Trump's comprehensive global tariff policy on company performance.

Roundhill Investments CEO Dave Mazza said: "Currently, corporate executives' behavior is similar to that of institutional investors: they act cautiously, conservatively, and are highly sensitive to valuations."

Moreover, economic data has also become increasingly worrisome. The latest employment report released on Friday shows that the labor market is slowing down, with three months' job growth declining sharply, and the unemployment rate rising last month. Additionally, the consumer spending has shown little growth.

Differentiated from Market Sentiment

Of course, investors need to be cautious when interpreting insiders' buying and selling behavior, as there may be other factors at play beyond market performance. However, corporate executives' lack of enthusiasm for their own company stocks has formed a stark contrast with the widespread risk-taking sentiment on Wall Street in July. The S&P 500 index has not experienced three consecutive months of growth in recent years, and since April 8th's low point, this index has risen by more than 25%.

Furthermore, corporate buyback activities have slowed down last month, and from July 25th onwards, they have been below their usual seasonal levels for four consecutive weeks, as indicated by the latest data from American Banker Group strategist Jill Carey Hall.

The company acknowledged that one reason for this situation is the delay in releasing quarterly reports due to the holiday on July 4th. However, Carey Hall's analysis shows that since March, stock buybacks have consistently decreased as a percentage of market capitalization, indicating that "interest rate increases and valuations may finally be affecting corporate sentiment." Mazza added: "This cautious attitude towards buying back shares reflects their greater focus on protecting company assets rather than transmitting market confidence signals. Given the current market upswing, this attitude is significant."

According to Sameer Samana, a senior global market strategist at Franklin Templeton Investment Institute, analysts who closely follow corporate stock buyback data may consider that these activities are more reflective of market sentiment than insider selling behavior. This is because individuals often have continuous funding needs and tend to adjust their asset allocation by concentrating on the stocks they hold.

However, taking a comprehensive view, the phenomenon of companies and their executives lacking confidence in their own stocks does deserve investors' attention. Samana said: "Those who know best about company situations tell you that many good news have already been discounted."