Palantir (PLTR.US) Faces a Crucial Test! Can Earnings Support Its High Valuation?

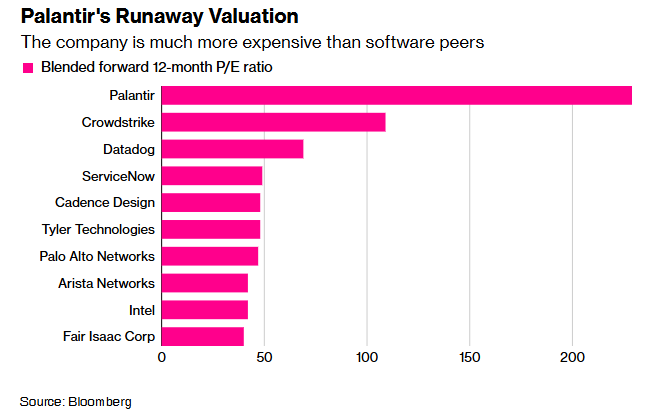

According to Zhitong Caifeng, investors are seeing a familiar scene before Palantir's earnings report - the stock price is near its historical high, and the price-to-earnings ratio is at the top among S&P 500 constituent stocks. Wall Street has long been cautious about Palantir's valuation, giving it "sell" or "hold" ratings from analysts who are twice as many as those with a "buy" rating. The company's long-term price-to-earnings ratio is as high as 236 times, which is more than double that of CrowdStrike (CRWD.US), the second most expensive tech company, and eight times that of its peers.

Despite this, investors continue to pump money into the stock, and it has a large following of retail investors. Bulls ignore the high valuation and focus on Palantir's growth potential, including its close relationship with the US government, expanding commercial product lines, and applications in artificial intelligence.

However, this frenzy has raised some concerns. If Palantir wants to satisfy investors, it needs to achieve extremely high expectations when releasing earnings on Monday night after the US market closes. Robert W. Baird & Co. managing director Ted Mortonson said, "Palantir is currently in a position where it must deliver explosive data, and it must thoroughly beat market expectations."

Gil Luria, head of technology research at DA Davidson, noted that Palantir's earnings per share have easily surpassed expectations in the past few quarters. He believes the company seems to have more momentum than any other listed software company and that market expectations are unprecedentedly high. He mentioned that Palantir is expected to achieve a 35% organic revenue growth rate in 2025, ranking first among its tracked 100+ software companies. Palantir also has the highest expected free cash flow and a profit margin of 42%. However, Gil Luria also emphasized that he is "very clear" that the company's valuation is absurdly high, which is why his institution gave it a "neutral" rating.

Analysts will assess Palantir's efforts to expand its government business (including those in the US and other countries). Wedbush Securities analyst Daniel Ives emphasized that the company has recently signed a contract with the US Army worth $100 billion, which is an additional tailwind. In the commercial field, Gil Luria said that Palantir "needs to build on the success of its AI pilot projects and convert these new customers into long-term partnerships."

Moreover, Gil Luria warned that Palantir will increasingly face a "battle for AI talent". In recent weeks, Alphabet's Google reportedly acquired AI programming startup Windsurf for approximately $2.4 billion, hiring the top employees and obtaining licensing rights. Meta (META.US) also lured several AI talents to its "super smart" team with extremely high salaries.

Wealth Consulting Group chief investment officer Jim Worden said that despite Palantir's expensive stock, there are still reasons to hold it. He added that Palantir may be at a stage similar to when Apple released the iPhone. He said, "I hear many people say it's too expensive and already perfectly priced. But if they really are in this 'iPhone moment' - such as earning $10 billion per quarter, growing to $100 billion or even $200 billion - then they may be able to grow into matching this valuation."