Federal Reserve and Statistician High-Level Changes Spark Trust Crisis, US Assets Under Pressure

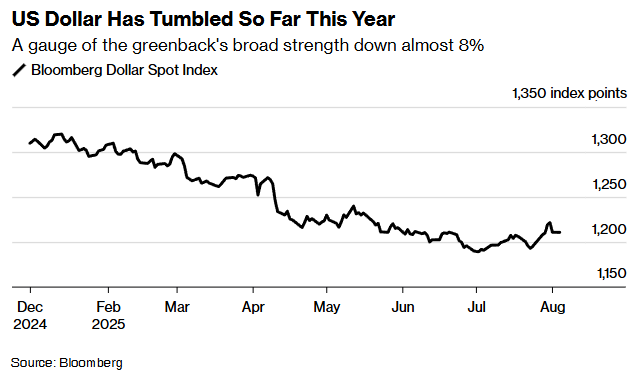

According to Zhitong Caijing APP, Wall Street strategists and economists point out that due to the vulnerability of the credibility of U.S. government institutions, including U.S. assets such as dollars, which may face further selling risks.

Following the resignation of Federal Reserve member Adriana Kugler last Friday, U.S. President Trump now has the opportunity to appoint her successor, which could weaken Chairman Powell's influence. Additionally, Trump fired Erika McEntarfer, Director of the Bureau of Labor Statistics, last week, causing market concerns about the independence of economic data and monetary policy. This uncertainty may lead investors to revalue U.S. assets downward. This concern has already affected dollars this year, with some funds transferring their money out of U.S. bonds and stocks.

In the backdrop of slowing economic indicators, concerns about politicization of U.S. institutions have also warmed up. Robert Bergqvist, a senior economist at SEB Bank in Sweden, noted that "unfortunately, we are witnessing a new serious attempt to concentrate more power in the White House." All these developments prove that it is reasonable to expect higher risk premiums for holding different U.S. assets.

Last Friday's release of the U.S. July nonfarm payrolls data has led traders to increase their bets on a Fed rate cut in September. The currency market pricing shows that the probability of a Fed rate cut in September is now higher than not cutting rates.

Elias Haddad, a strategist at Brown Brothers Harriman, noted that "the credibility of U.S. policymakers is facing increasingly severe threats." He pointed out that Trump's pressure on Powell and his colleagues to cut rates "has undermined the independence of the Fed."

Although investors had already anticipated Trump would appoint a more dovish Fed chair, this means that after Powell's term ends next year, the Fed will likely accelerate its rate-cutting pace. However, Kugler's resignation has pushed forward this timeline. Trump's nominee may take over as chairman in May next year, potentially triggering the "shadow chair" effect, where investors focus more on the incoming chair's guidance rather than Powell himself.

Elias Haddad also noted that firing Erika McEntarfer could "harm external perceptions of the credibility of U.S. economic data." Macro strategist Mark Cudmore also stated, "Trump's firing of the Labor Statistics Director is a negative signal for markets – either it means that previous data was flawed or that data was once accurate but now will be politicized. Regardless of which scenario plays out, future data releases will be affected, and U.S. assets should reflect higher risk premiums."

Mitsubishi UFJ Financial Group's (MUFG) global market research chief in London, Derek Halpenny, noted that among the potential nominees to succeed Powell, Kevin Hassett, Chairman of the Council of Economic Advisers, is "the worst choice for the dollar," as he has a close relationship with Trump. He added that Treasury Secretary Steven Mnuchin also faces negative sentiment due to his connection with Trump, although its impact is not as severe as Hassett's.

Derek Halpenny further noted that relative to the other potential nominees, former Fed members Kevin Walsh and Christopher Waller, and current Fed member Michelle Bowman, are more popular among market participants due to their experience at the central bank. He stated, "Before the formal announcement, investors will keep their interest in buying back the dollar limited after its decline last Friday."

Regardless of what happens, Trump's nomination of a new Fed member to replace Kugler will be an important risk event for markets. Trump announced on Sunday that he plans to name Kugler's successor in the next few days.

The Deutsche Bank strategy team led by Jim Reid noted, "Changes at the Fed and Labor Statistics Bureau may ultimately affect the financing difficulties of U.S. 'twin deficits.' This could impede long-term bond yields from rising unless there is a significant slowdown in economic growth."