Dollar Asset Preferences Relaxing, Taiwanese Investors Shift Focus to Europe

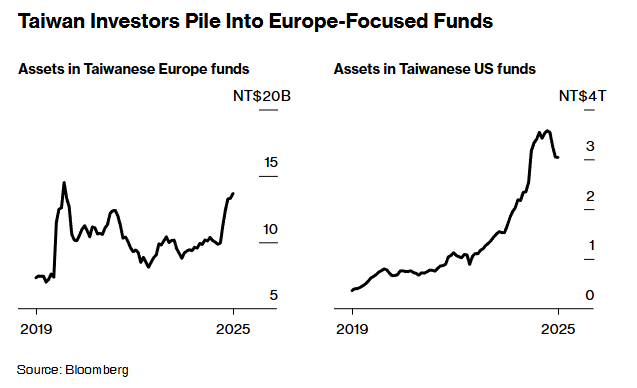

According to our sources at Zhitong Caiping APP, as global funds are gradually moving away from dollar assets, Taiwanese investors are not an exception. They are re-evaluating their long-term preferences for dollar assets and shifting their focus towards Europe. Data shows that by the end of June, Taiwanese funds holding European assets have attracted a significant amount of investments, with total assets reaching NT$137 billion (approximately $4.63 billion), a record high since 2019. Additionally, according to data from Taiwan's Securities Investment Trust & Consulting Association (SITCA), in the first half of 2025, Taiwanese investors injected NT$141 billion into foreign funds with a focus on Europe, setting a new record since 2021.

Meanwhile, in the first half of 2025, Taiwanese local funds with a focus on the US saw their total assets decrease by NT$538 billion, setting a new record since 2003. The value of foreign funds held by Taiwanese investors also decreased by NT$1216 billion, the largest decline since SITCA started recording such data in 2006.

This shift marks a significant change in asset allocation strategies for Taiwan's high-net-worth institutional investors. Previously, these investors had long prioritized US assets in their overseas investment portfolios. Taiwan is the 11th largest foreign holder of US government bonds, with total holdings as of May reaching $2929 billion, down from April by $59 billion and a record single-month decline since September 2022.

This shift is not unique to Taiwan. The trade war launched by former US President Trump, the increasing federal government deficit, and intensifying political polarization are prompting major Asian economies to seek alternative solutions to diversify their investments in the US stock and bond markets, which total over $75 trillion.

Agnes Lin, a market strategist at Morgan Stanley's asset management division, said, "Banks and insurance companies are moving very quickly to shift their assets." "Clearly, they have a long-term diversification strategy in place." Morgan Stanley currently manages Taiwan's largest European-themed fund. Agnes Lin predicts that if the European stock market continues its upward trend next year, individual investors in Taiwan will also start paying attention to this region.

Data shows that Taiwanese insurance companies' overseas investments of NT$220 billion have more than 90% of their assets concentrated in dollar-denominated assets. This high concentration poses significant foreign exchange risks for these companies. When the New Taiwan dollar surged against the US dollar at the beginning of May, local insurance companies suffered a total loss of over NT$1450 billion from currency fluctuations. ETF investors who focus on US bonds also felt the impact of the dramatic foreign exchange rate movements, prompting discussions in Taiwan's market about whether it is necessary to diversify assets more broadly.

As of now, the New Taiwan dollar has appreciated by over 11% against the US dollar this year, while depreciating 1.4% against the euro. Arnaud Tellier, head of Asia's wealth management business at French bank BNP Paribas, noted that Taiwan's wealthy families have been affected by the sharp fluctuations in the New Taiwan dollar. He said, "We're seeing them start to pay attention to how they can diversify their assets away from dollar-denominated assets. We've received many inquiries about other currencies, especially the euro."