Global Banks May Present a "Golden Window" Opportunity: European and Japanese Banks to Lead the Way

Zhitong Caijing APP has learned that a research report published by Swergelin indicates that the global banking industry is showing strong investment potential under the current macroeconomic environment, particularly in Europe, the UK, Japan, and Brazil. The report notes that despite facing numerous challenges, the banking sector still has multiple support factors and valuation space for repair.

Macroeconomic Environment and Valuation Advantages

The strategy team led by Andrew Garthwaite believes that the banking industry currently has multiple advantages.

Firstly, on a macro level, banks can serve as tools to counter populist movements, which often lead to fewer immigrants, more local manufacturing, fiscal easing, higher minimum wages, and protectionism. This will drive up bond yields and steepen the yield curve, benefiting banks; strong currencies can also make non-US banks winners; Europe's loan growth is accelerating, with Italian and German corporate loans growing significantly. In Europe, 37% of banks report increased loan demand in the mortgage lending sector, with European households and companies having relatively low leverage ratios.

Secondly, the current valuation of bank stocks relative to market norms has a discount of around 10%, which Swergelin believes should be reevaluated. The main reasons include: banks' credit risk is much lower now; non-macro factors that were previously unfavorable have weakened or disappeared; litigation and fines have decreased; industry disruption threats have diminished; and special tax risks have also reduced. Banks are currently undergoing consolidation, with European countries seeing a batch of large-scale cross-border acquisitions for the first time in over ten years, while US and UK markets are also experiencing integration. Bank stocks are becoming a new essential consumer product.

Tactical Factors Favorable

From a tactical perspective, bank stocks also have attractions. Firstly, they are not over-owned, ranking ninth in terms of ownership concentration. Secondly, profit momentum is strong, with European profitability revisions ranking second globally and fifth worldwide. Thirdly, from a global perspective, the PMI new orders and prices composite performance is strong.

Focused Attention on Certain Types of Banks

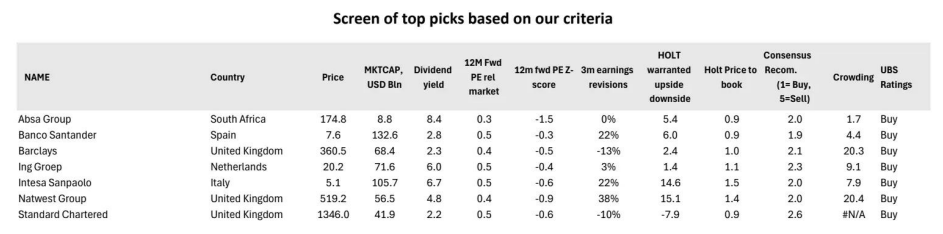

Swergelin highlights that the following types of banks are worth paying attention to: European, British, Japanese, and Brazilian markets; retail banks, which have relatively low sensitivity to interest rates compared to corporate lending; household lending growth is stronger, with AI and blockchain technologies potentially bringing more cost-cutting opportunities for retail banks; and cheap emerging market bank stocks, such as HSBC (02888) and Santander (SAN.US).

Be Aware of Potential Risks

Although the outlook is optimistic, Swergelin also warns investors to be aware of the following risks. 1) Credit spread risk: historically, when credit spreads rise, bank performance tends to be poor; however, Sweden's experience in 2022-2023 shows that as long as banks do not engage in high-risk lending, a small increase in credit spreads will not lead to an increase in defaults. This traditional relationship has been broken. 2) Stablecoin threats: although stablecoins are currently relatively small (around $240 billion compared to the US currency market fund's $70 trillion), regulatory progress may divert bank deposits and impact payment system profitability. 3) Lending to non-bank financial institutions: US banks have grown lending to non-bank financial institutions by over 10,000% since 2000, currently reaching around $12 trillion or approximately 30% of the US banking sector's assets; however, Swergelin believes that due to asset and liability matching, risks are relatively controllable.