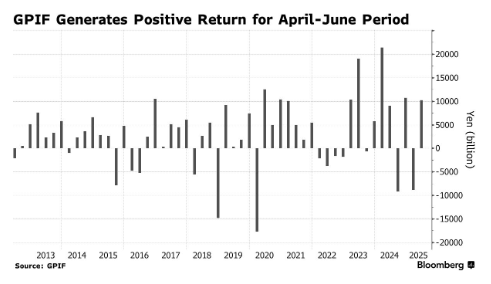

GPIF Sees Huge Profit After Trade War, Japanese Pension Fund Earns $6.8 Billion in Quarter

Zhitong Caifeng APP has learned that as the global and Japanese stock markets have strongly recovered from the US trade war-induced selloff, Japan's government pension investment fund (GPIF) has achieved significant returns over the past three months ending June.

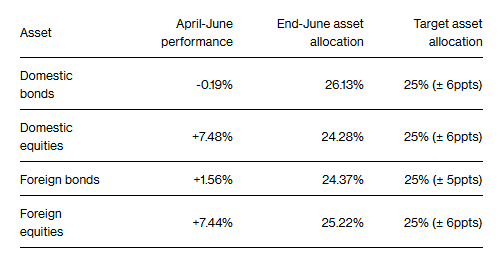

This largest pension fund in the world among others announced on Friday that it earned ¥102 trillion (approximately $6.78 billion) in investment gains for the quarter, up from ¥897 trillion last year, with a return rate of 4.09%. The total assets under management reached ¥260.02 trillion. Among them, Japanese domestic stocks returned 7.5%, while bonds saw a slight decline of 0.2%; overseas stocks returned 7.4%, and foreign bonds earned 1.6%.

This year, GPIF's investment performance has continued to fluctuate due to the impact of US trade tariffs and Japan's fiscal concerns on its bond market. In an interview last week, GPIF President Kazuto Uchida said that the fund can weather the recent fluctuations in domestic bonds and believes that the latest US-Japan trade deal will have a positive impact on stocks.

To cope with current market volatility, Japan's largest pension fund plans to strengthen its investment portfolio rebalancing through derivatives tools and conduct in-depth research on asset relationships. Since 2021, GPIF has rapidly expanded alternative investment configurations and established a dedicated team for related research.

According to GPIF's investment model, the fund will allocate its assets evenly among four major asset categories: Japanese domestic stocks, domestic bonds, overseas stocks, and foreign bonds, each with a target allocation of 25%.