Hayashi's Prudent Stance Can't Block Market Expectations: BOJ to Hike Rates in October?

It has been noticed that as US President Trump announced multiple agreements, including the Japan-US trade deal, market expectations for Japanese trade prospects have become clearer, and observers at the Bank of Japan (BOJ) are forecasting an earlier rate hike.

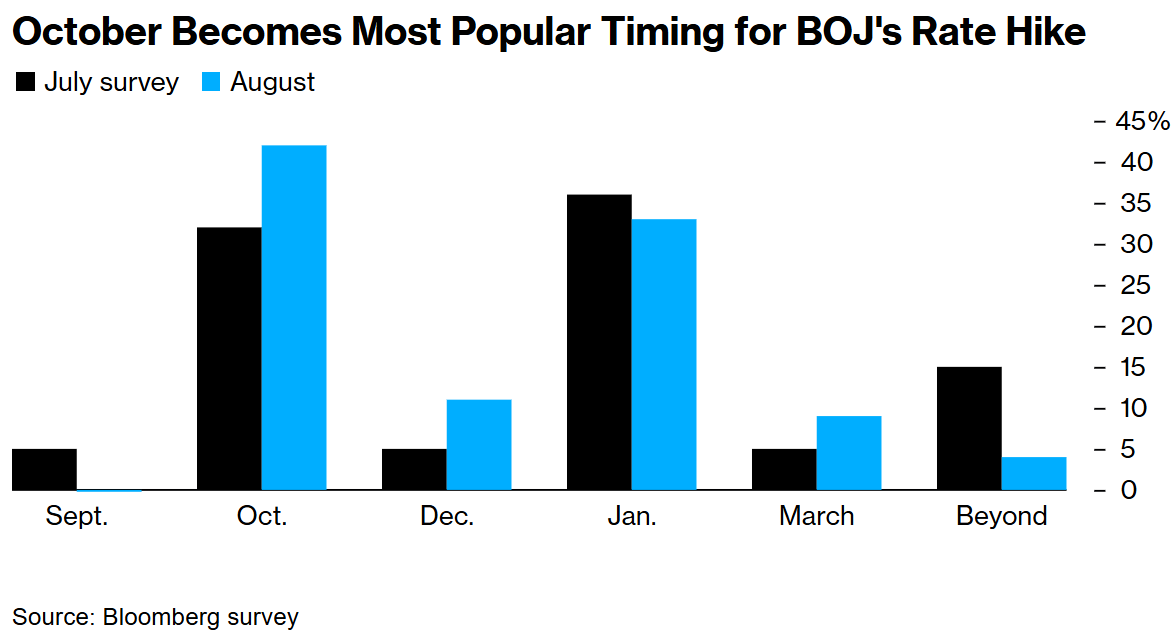

A latest survey shows that among 45 economists interviewed, about 42% predict the BOJ will raise interest rates in October, a significant increase from the previous survey's 32%. The survey was conducted before the release of the Japan-US trade deal and the BOJ's policy meeting on July 22. Predictions for a rate hike in January next year have slightly decreased to one-third, while predictions for a rate hike in December have doubled to 11%.

Although no one is considering September as the basic scenario for a rate hike, about one-quarter of respondents think it may be earlier than expected. About 60% believe that October could be the earliest start date for a rate hike.

October becomes the hottest date for BOJ rate hike

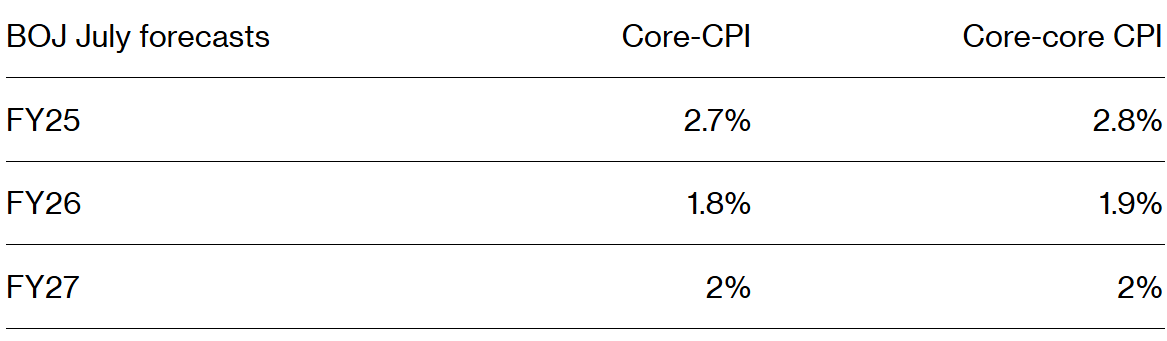

These results show that even after BOJ Governor Hayashi's cautious remarks, most observers still believe that a rate hike is approaching. Analysts point out that the BOJ's latest inflation forecast and risk assessment are evidence that it is paving the way for a rate hike.

A senior economist at Daiwa Securities, Kento Minami, said, "This meeting has laid the foundation for the next rate hike, considering that food prices are rising and the yen may be weak. If corporate activities prove resilient, the conditions for another rate hike this year will be met."

But Hayashi repeatedly emphasized the need for cautious analysis of data before considering a rate hike, suggesting that there is no pressing need to raise interest rates.

A chief strategist at Nomura Securities, Naka Matsuzawa, said, "Hayashi's remarks and the BOJ's statement are still biased towards hawkishness. Partly because the BOJ governor denies the possibility of policy lagging behind the curve – for the BOJ, policy lag is a taboo."

A survey shows that 49% of economists believe Hayashi's stance was neutral, 44% were slightly bearish, and only 5% were hawkish.

Related comments led to the yen falling below its psychological barrier of 150 against the US dollar, touching its lowest level since March. Given that a weak yen has been a key factor driving Japanese monetary policy towards tightening, analysts believe history may repeat itself.

About 44% of respondents think the yen is becoming a key factor in prompting a rate hike, while 35% hold the opposite view, and about 20% are unable to make a judgment.

A chief Japanese economist at Morgan Stanley MUFG Securities, Takeshi Yamaguchi, said, "If the yen depreciates sharply, the BOJ may choose to raise interest rates earlier, emphasizing potential inflationary risks."

Except for the economic pressure from tariffs and a weak yen, many analysts point out that political uncertainty may become an obstacle for the BOJ's monetary policy operation. Prime Minister Abe, who suffered a historic defeat in the Upper House election on July 20, is facing pressure to resign.