Hong Kong Exchanges Optimizes IPO Pricing Mechanism: Public Subscription Ratio Adjusted to 35%, Reserves for Cornerstone Investors 6-Month Lock-up Period

Zhitong Caixin APP has learned that on August 1, the Hong Kong Exchanges (00388) wholly-owned subsidiary, the Hong Kong Stock Exchange Limited (HKEX), announced optimizations to the IPO market pricing and public market regulations. The new rules will take effect on August 4, 2025. Among the changes, the public subscription ratio has been adjusted to a maximum of 35% (previously recommended at 20%), while retaining the 6-month lock-up period for cornerstone investors. Additionally, HKEX is introducing new requirements for initial free float shares to ensure sufficient tradable shares on listing. Moreover, HKEX is consulting further on its continuous public holding quantity regulations with a view to enhancing market flexibility and strengthening shareholder rights protection.

Summary of the First Public Offering Market Pricing and Public Market Reform Recommendations

HKEX received 1,253 non-redundant responses from various stakeholders on its consultation document. After considering these opinions, HKEX will adopt most of the recommendations with minor revisions.

Hong Kong Exchanges Chief Executive Officer, Wai Chi-sing, said: "As one of the world's most active IPO markets, Hong Kong has attracted issuers from various industries over the past 20-odd years. The increasing scale of new issues has also attracted a growing number of international investors. To maintain our competitiveness and attract more excellent companies to list in Hong Kong, we must continuously optimize our listing rules to ensure they align with international market standards."

Wai Chi-sing continued: "HKEX hopes that this reform will enhance the stability of IPO pricing and distribution mechanisms while balancing the needs of different types of local and international investors participating in new issues. At the same time, we have revised our initial public holding quantity requirements to provide issuers with greater flexibility and certainty. We are introducing new requirements for initial free float shares to ensure sufficient tradable shares on listing. We would like to express our heartfelt gratitude to all market participants who provided valuable opinions during the consultation process, helping us adjust and finalize our plan for promoting the sustainable development of Hong Kong's IPO market."

The main changes to the listing regulations include:

First Public Offering Market Pricing Mechanism

1. Minimum allocation percentage: The issuer must initially allocate at least 40% of the shares sold on a first-come, first-served basis (previously recommended at 50%).

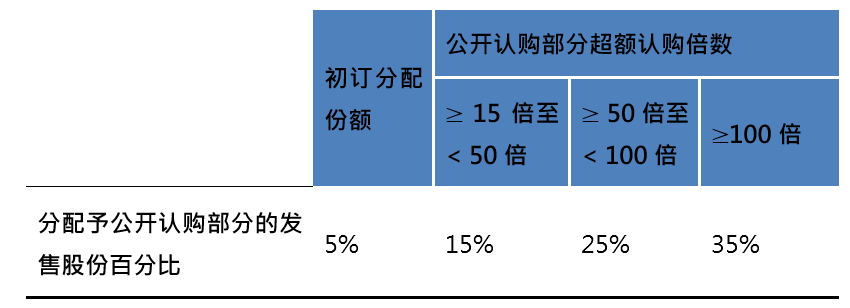

2. Allocation to public subscription: Allowing new listed companies to choose between Mechanism A or Mechanism B as their initial public offering pricing mechanism:

Mechanism A: Replacing the existing allocation and clawback mechanism with a specified allocation ratio for public subscription:

The maximum public subscription ratio has been increased from 20% to 35%.

Mechanism B: Introducing a new mechanism option requiring issuers to pre-select an allocation ratio for public subscription, with a minimum of 10% (maximum of 60%) and no clawback mechanism:

The maximum public subscription ratio has been increased from 50% to 60%.

Unadopted suggestions: HKEX will retain the existing lock-up period regulation for cornerstone investors, maintaining investor commitment. Additionally, considering feedback from stakeholders during the consultation process, HKEX will not implement the proposed flexible pricing mechanism.

PUBLIC MARKET REGULATIONS

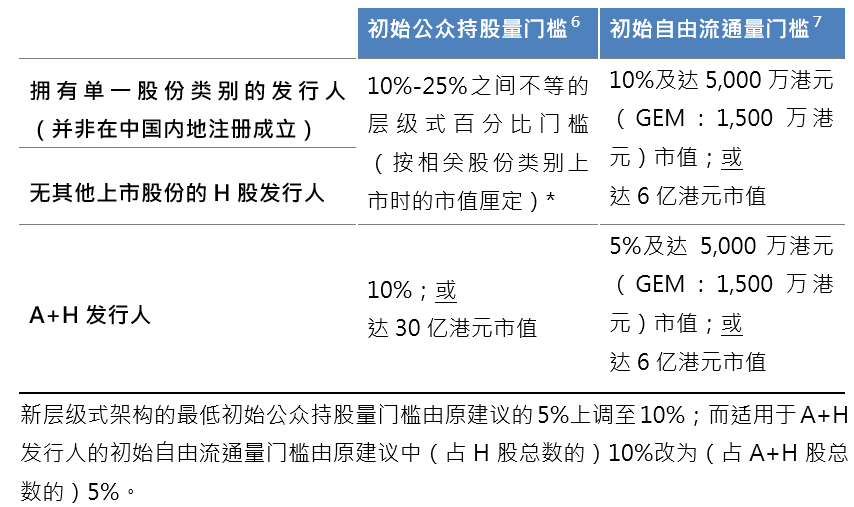

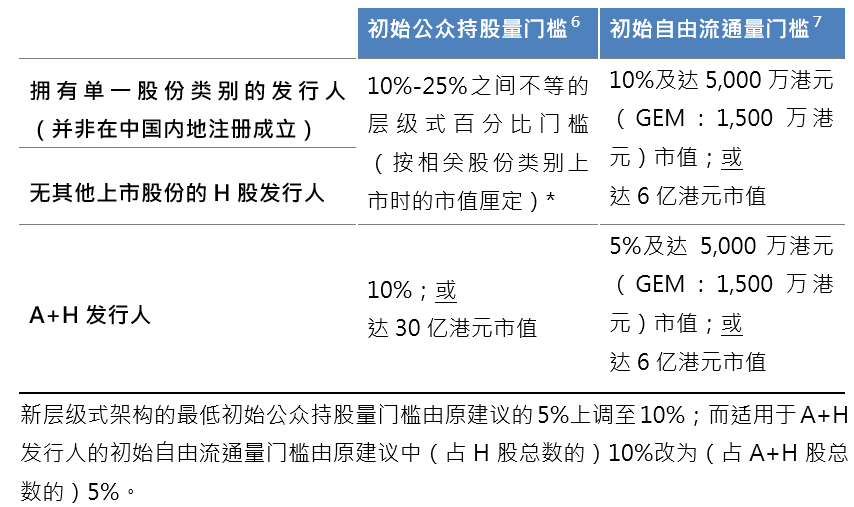

3. Initial public holding quantity and free float shares: Issuers must meet the following minimum public holding quantity and free float share requirements:

HKEX will continue to have discretionary powers to exempt individual applicants from these regulations based on specific circumstances. The new regulations will take effect on August 4, 2025, and apply to all issuers and newly listed companies that publish their listing documents on or after that date.

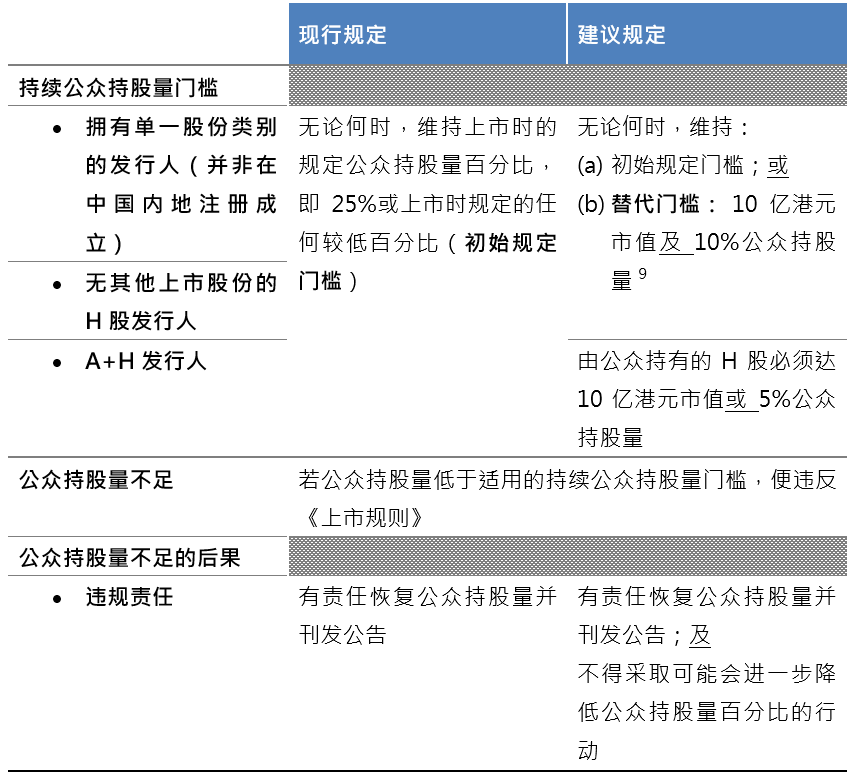

The current continuous public holding quantity regulation has been revised in a transitional manner to ensure compatibility with the new initial public holding quantity requirements. Once the further consultation on continuous public holding quantity regulations (see below) is complete and implemented, the new regulations will supersede these transitional arrangements.

Further Consultation on Continuous Public Holding Quantity Regulations

In response to market opinions on establishing appropriate continuous public holding quantity regulations, HKEX is also consulting further on the detailed recommendations for these regulations.

Wai Chi-sing said: "We are thrilled to consult further with the market on our continuous public holding quantity regulations. We are committed to continuously optimizing Hong Kong's listing rules to meet the needs of various industries and different-scale issuers. This reform provides issuers with greater flexibility, enables better capital management, and introduces measures to prevent long-term irregularities from occurring, strengthening shareholder rights protection. We would like to express our heartfelt gratitude to market participants for their continued valuable opinions."

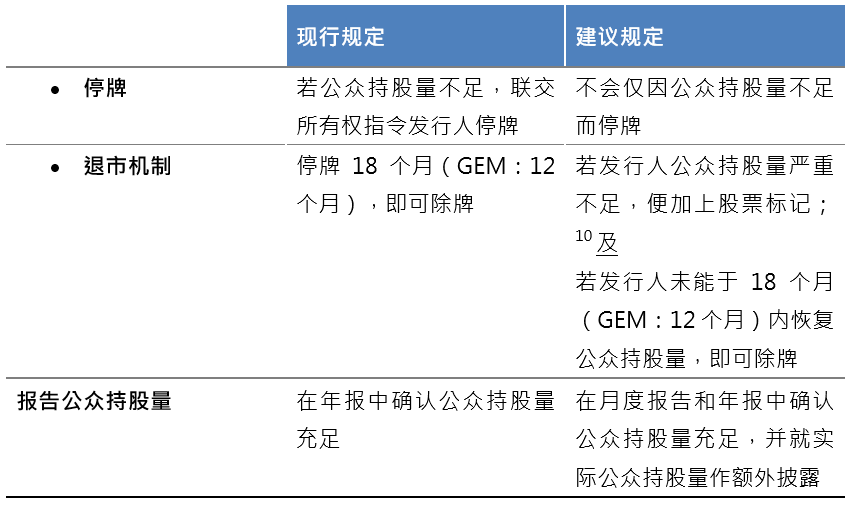

A comparison of the current and recommended continuous public holding quantity regulations is as follows:

HKEX is currently consulting with the market on its recommendations for continuous public holding quantity regulations and the necessary revisions to listing rules. The public consultation period will end on October 1, 2025.