Hong Kong Stock Market 2025 Mid-Year Report: Average Daily Trading Volume Up 118% ETF, Derivatives All See Explosive Growth

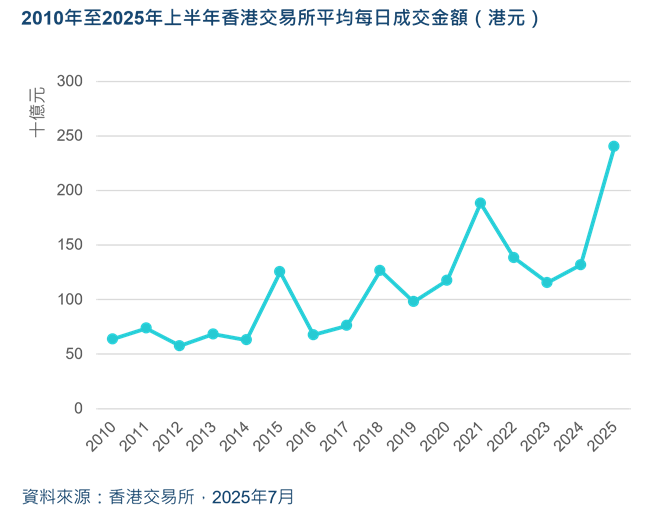

Zhitong Caifeng APP has learned that on July 29th, the Hong Kong Stock Exchange released a review of the highlights of the Hong Kong market in the first half of 2025. In the first half of 2025, the Hong Kong market saw significant growth, with the performance of the secondary market of the Hong Kong Stock Exchange standing out particularly brightly - stock market trading volume continued to rise, and derivatives trading volume surged. The data shows that the average daily trading volume in the Hong Kong Stock Exchange for the first half of 2025 was HK$2,402 billion (covering more than half of the top ten trading days in the exchange's history), up 118% from the same period last year.

Daily Trading Volume of ETFs Rises to HK$338 Billion, Up 184% from Last Year

The average daily trading volume of exchange-traded funds (ETFs) in the first half of 2025 rose sharply to HK$338 billion, up 184% from last year. This growth was mainly driven by two innovative initiatives: the expansion of ETF connectivity and the continuous launch of new products.

Daily Trading Volume of Leveraged and Inverse Products Up 75% from Last Year

The average daily trading volume of leveraged and inverse products in the first half of 2025 rose to HK$42 billion, up 75% from last year. Hong Kong is leading the way as Asia's most diversified market for leveraged and inverse products, with the first batch of individual stock leveraged and inverse products set to be listed this year.

Bearish Certificates Growing in Popularity, Average Daily Trading Volume Reaches HK$96 Billion, Up 78% from Last Year

Bearish certificates tracking various asset performances saw their average daily trading volume rise to HK$96 billion in the first half of 2025, up 78% from last year.

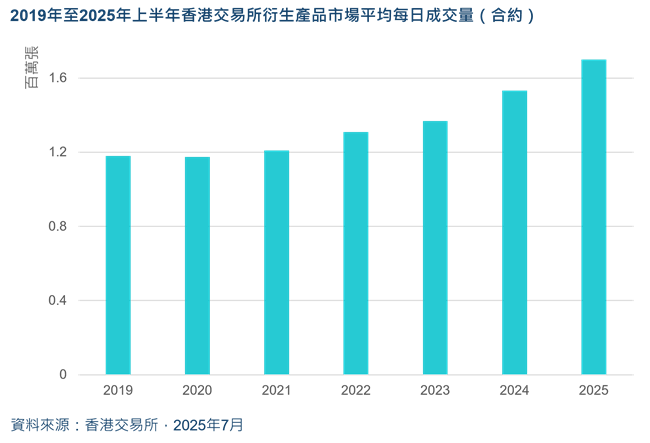

Average Daily Trading Volume of Derivatives Reaches 1.7 Million Contracts, Up 11% from Last Year

The average daily trading volume of derivatives products in the first half of 2025 rose to 1,702,322 contracts, up 11% from last year.

HK-Mainland Stock Connect Daily Trading Volume Surpasses HK$1.1 Trillion, Up 195% from Last Year

The daily trading volume of the Hong Kong-Shanghai Stock Connect mechanism in the first half of 2025 surged to HK$1,109.6 billion, up 195% from last year.

PBOC Gold Futures Trading Volume Exceeds 115,000 Contracts, Up 43% from Last Year

The daily trading volume of PBOC gold futures in the first half of 2025 rose to 115,150 contracts, up 43% from last year. This reflects the increasing vitality of PBOC-denominated products in the yuan-pegged tool ecosystem.

Market Capitalization of Hong Kong Reaches HK$427 Trillion, Up 33% from Last Year

As of June 30th, the market capitalization of Hong Kong reached HK$427 trillion, up 33% from last year.

The first half of 2025 was a breakthrough period for the Hong Kong capital market. Strong securities market trading volumes combined with growing derivatives markets have confirmed the resilience and innovative potential of Hong Kong's secondary market, attracting international capital and providing diversified investment tools for investors.