New Share Outlook: Lemo Material Union: Intelligent Massage Chair Leader's Second Listing, How to Break Through Growth Anxiety?

Capturing the shared economy and big health trends, shared massage chairs have become an indispensable "configuration" in public spaces such as shopping malls, cinemas, and high-speed rail stations. After experiencing early chaos expansion, market reshuffling, and eventually stabilizing market share, remaining enterprises have become more resilient.

Recently, intelligent massage service supplier Lemo Material Union Technology Co., Ltd. (hereinafter referred to as "Lemo Material Union") submitted an IPO application to the Hong Kong Stock Exchange, with CITIC Securities International and Shunwei Capital as joint sponsors. Notably, this is Lemo Material Union's second listing, after its previous one in January 21st, 2025.

As a leading shared intelligent massage chair company, Lemo Material Union has launched two " olive branches" in the Hong Kong market, seemingly hinting at future growth anxiety.

Business rapid expansion, profitability pressure

Lemo Material Union was established in 2014 and launched its "Lemo Bar" brand in 2016, dedicated to providing machine massage services to consumers in various scenarios, including commercial complexes, cinemas, transportation hubs (including airports and high-speed rail stations), etc. Consumers can enjoy multiple minutes of massage services by scanning the QR code.

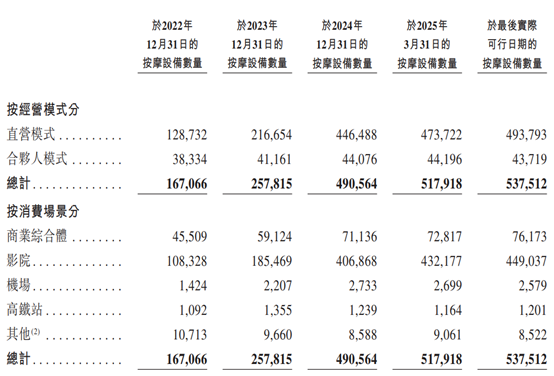

As of now, the company has established more than 48,000 service points for machine massage services, deployed over 535,000 machines, covering 31 provinces and 339 cities in mainland China. The number of service points increased from 21,727 in 2022 to 45,993 by the end of 2024, with a compound annual growth rate (CAGR) of approximately 45.49%.

Regarding consumer coverage, the company has a solid market position, with cumulative recognizable service users exceeding 165 million and registered members exceeding 32 million as of the last practicable date.

From a financial perspective, Lemo Material Union's main revenue comes from machine massage services and other related businesses. In 2022-2024, the company recorded revenues of RMB 3.30 billion, RMB 5.87 billion, and RMB 7.98 billion respectively, achieving a threefold increase in revenue over three years. The company's 2023 revenue grew by 77.7%, while its 2024 revenue growth slowed down to approximately 36%.

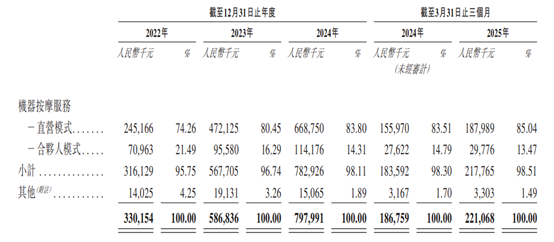

From an income source perspective, Lemo Material Union's main revenue comes from machine massage services, accounting for 98.11% of the business in 2024. Other businesses include selling online and digital advertising services.

In the most profitable machine massage services business, Lemo Material Union operates in two modes: direct operation and partnership mode. The direct operation mode accounts for approximately 71% of service points, while the partnership mode accounts for 29%. Direct operation mode brings in over 80% of revenue, with the remaining 14.31% contributed by the partnership mode.

From a profitability perspective, the company's net profit attributable to shareholders was RMB 648.1 million in 2022, increasing 12 times to RMB 8734 million in 2023, and decreasing slightly to RMB 8580.7 million in 2024.

It is not difficult to see that 2023 became a "golden moment" for Lemo Material Union, with its gross profit margin, operating profit rate, and net profit rate all significantly increasing. The gross profit margin increased from 25.8% to 41.8%, while the net profit rate increased from 2.0% to 14.9%. In 2024, the company's high-speed growth showed signs of slowing down.

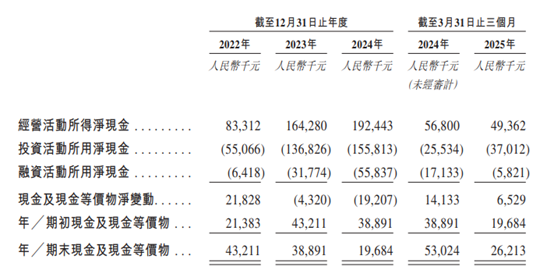

According to data for the first quarter of 2025, the company recorded a single-quarter revenue of RMB 2.21 billion, with a year-on-year increase of 18.4%, and a net profit of RMB 2333.8 million, decreasing by over 10% from the previous year.

Further examination of the prospectus reveals that this seems to be an "unseen" cost risk: in 2024, the company's sales costs increased significantly, outpacing revenue growth, resulting in a 5.7 percentage point decrease in gross profit margin. At the same time, the company's marketing expenses and administrative expenses also showed rapid growth.

Moreover, the company's operating cash flow has been increasing year-on-year, but the pace of growth seems to be slower than the increase in expenses. The company's net cash inflow from operations has been expanding year-on-year, leading to a decrease in cash and cash equivalents. As of December 31st, 2024, Lemo Material Union held RMB 1968.4 million in cash and cash equivalents, which urgently needs to be replenished.

After the "run and circle" game, what's next?

According to Frost & Sullivan data, China's intelligent massage service market size grew from RMB 17.21 billion in 2020 to RMB 27.07 billion in 2024, with a compound annual growth rate (CAGR) of 12.0%. It is expected to grow to RMB 31.02 billion in 2025 and RMB 56.06 billion in 2029, with a CAGR of 15.9%.

According to the report, Lemo Material Union ranked first in terms of transaction volume among all intelligent massage service providers in mainland China for three consecutive years from 2022 to 2024, with market share rates of 33.9%, 37.3%, and 42.9% respectively.

For Lemo Material Union, after experiencing chaotic expansion, market reshuffling, and eventually solidifying its leading position, the company's future growth requires in-depth understanding of consumption scenarios.

Currently, Lemo's service points are distributed across various scenarios, including commercial complexes, cinemas, transportation hubs (including airports and high-speed rail stations), etc. If we break down the data by scenario, as of December 31st, 2024, the company's machine massage service revenue from each scenario was RMB 1.35 billion from commercial complexes, RMB 2.15 billion from cinemas, RMB 0.45 billion from airports, RMB 0.25 billion from high-speed rail stations, and RMB 0.20 billion from other scenarios.

This means that the company's investment in commercial complexes has contributed significantly to its revenue, while its investments in cinemas have not been as effective. In terms of conversion rate, it is difficult to say that this is an effective strategy.

Furthermore, the shared massage chair industry is still facing cost pressure, with high rental costs and intense competition for high-quality points. The company's procurement costs and return periods are also not small pressures. At the same time, consumers' habits have yet to be cultivated, with over 70% of users being occasional consumers (using the service on an ad-hoc basis), lacking stickiness and price sensitivity, limiting the effectiveness of promotional activities.

Currently, the industry is shifting towards scenario-based operations, with short-term challenges including health, maintenance, and profitability. Long-term development requires relying on technological innovation, scenario deepening, and strict cost control. If the company can break through user experience bottlenecks and take advantage of the upgrading trend in "health consumption," there will still be potential for the company to become a supplementary industry in offline traffic economy.

In the prospectus, Lemo Material Union also mentioned that the IPO funds raised will mainly be used to expand service points, enhance technological innovation, improve brand awareness, and support operational cash flow. In this context, pre-IPO funding replenishment can further solidify its leading position in the industry.