New Stock Insights | Smart Car Market Continues to Heat Up, Will Magnicai's Hong Kong IPO Win Over Investors?

Magnicai Inc. (hereinafter referred to as Magnicai) has submitted its listing application to the Hong Kong Stock Exchange (HKEX), with CITIC Securities, JPMorgan Chase & Co., and Deutsche Bank serving as joint sponsors.

Since its inception, Magnicai has received investments from numerous well-known institutions, including M31 Capital, Zhi Road Capital, Nan Shan Capital, Redpoint Ventures, Huaying Investment, Shun Feng Capital, Guangzhou Development Fund, Beijing Zhongtian Fund, and Zhongguancun Group, among others. As of the D+ round, Magnicai's post-investment valuation reached USD 9.31 billion (approximately CNY 67 billion).

The prospectus shows that Magnicai is a leading Chinese company that has developed fully standardized, modularized, and software-driven integrated domain control solutions for the automotive industry, and is one of only two suppliers capable of providing comprehensive smart voice systems for in-car infotainment and parking solutions with an accuracy rate of 99%, which is the highest level in the industry.

The automotive industry is rapidly transitioning towards intelligentization, electrification, and networking. In this context, Magnicai's IPO is expected to receive close attention from the market.

AI-driven Integrated Domain Control Solution Achieves Year-on-Year Compound Growth Rate of Over 90%

The company's R&D expenses for 2022-2024 were CNY 2.62 billion, CNY 2.9 billion, and CNY 3.58 billion, respectively, accounting for 67.5%, 19.2%, and 25.2% of its total revenue.

The company's revenue grew from CNY 3.88 billion in 2022 to CNY 14.20 billion in 2024, with a compound annual growth rate (CAGR) of 91.3%. The net loss for the same period was CNY 4.23 billion, CNY 3.57 billion, and CNY 2.91 billion, respectively.

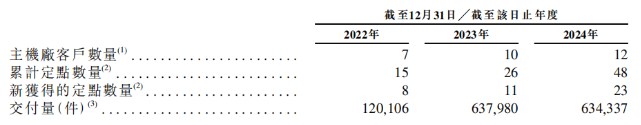

As a result of the company's efforts to stop cooperating with certain terminal customers that do not meet its long-term development goals, Magnicai's delivery volume in 2024 was slightly lower than in 2023. However, the company has actively adjusted its resources to more advanced fields, leading to a significant increase in its gross margin from 12.1% in 2023 to 21.8% in 2024.

Magnicai's products adopt a modularized and reusable software architecture, which means that its customers can significantly shorten their product development cycle, reduce R&D expenses, and have more opportunities to differentiate their products.

As of 2022-2024, the company's R&D expenses for each "ongoing project" (defined as a project that is ongoing but has not been canceled or terminated during the year) showed a significant decline in absolute terms and as a percentage of revenue.

The company's business has grown rapidly since its first product was launched in 2022. According to its prospectus, Magnicai's solutions have been applied to multiple car models from top-tier automakers such as Qoros, Changan, Dongfeng, and Ford, with an estimated 1 out of every 10 new cars sold in China using Magnicai's technology.

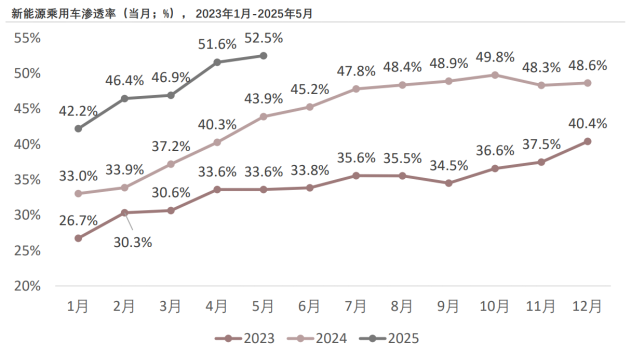

New Energy Vehicle Penetration Rate Continues to Rise; Smart Seatbox May Become a New Battlefield

As the automotive industry continues to grow, new energy vehicles are becoming increasingly popular. In the first half of 2025, China's new energy vehicle market saw rapid growth, with total sales reaching 693.7 million units and penetration rate reaching 44%, according to data from the China Association of Automobile Manufacturers.

At the same time, new energy vehicle manufacturers such as Ideal and Xiaopeng are also gearing up for profitability. According to their prospectuses, both companies have set targets for achieving profitability in the second half of 2025.