Non-Farm Data Gap: September Rate Cut Expectations Regress

Zhitong Caijing APP has learned that Zhongsan Securities released a research report stating that the July non-farm data was significantly lower than expected, with a previous value adjusted downward in a step-like manner, reflecting the rapid cooling of labor market demand-side growth rate compared to supply-side growth rate. The government department changed from a positive contributor to a negative one, while manufacturing and commercial services both showed fatigue. After the data release, the overseas market's September rate cut expectations regressed, with the US dollar index reverting its upward momentum and falling to around 98.9 levels. The yield curve of US Treasury bonds became significantly downward-sloping, with the 2-year yield falling by 22.6 basis points to around 3.7% levels, sensitive to Fed policy.

Zhongsan Securities' main views are as follows:

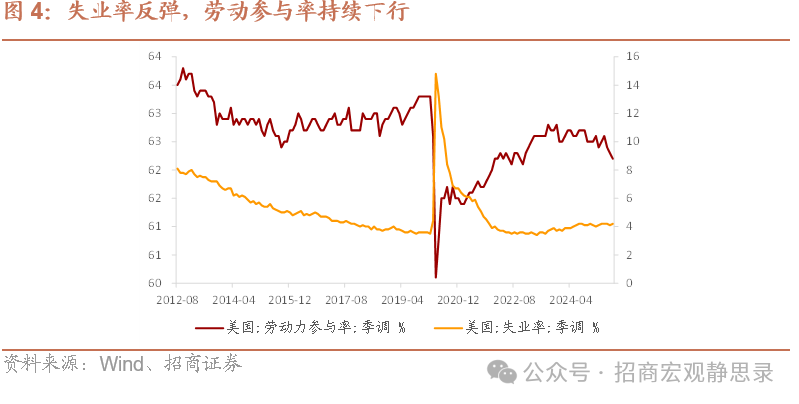

Event:On August 1, 2025, the US Bureau of Labor Statistics (BLS) released data showing that in July, non-farm employment added 73,000 jobs, down from the previous month's 147,000 jobs; the unemployment rate was recorded at 4.2%, down from the previous month's 4.1%.

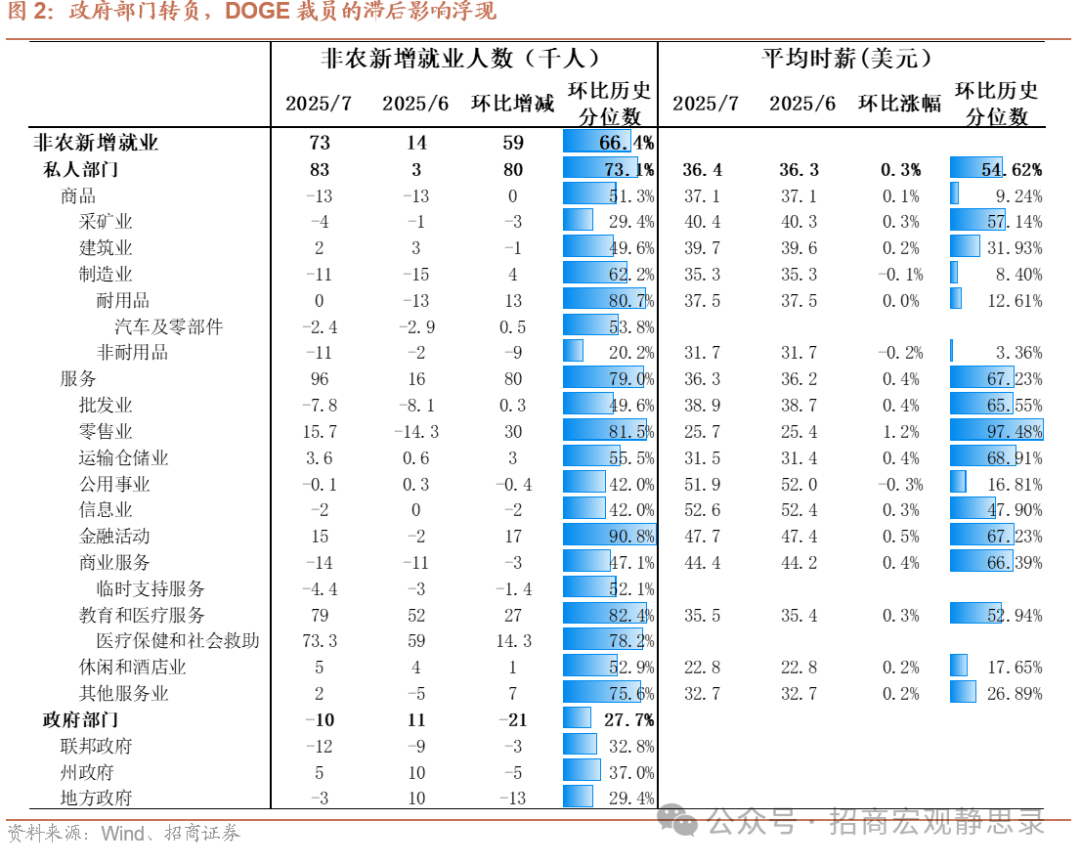

1) In July, non-farm employment added 73,000 jobs, lower than market expectations of 104,000 jobs, and the previous month's data was significantly adjusted downward by 25.8 million people.

2) By sector: Manufacturing, commercial services, and government departments all showed fatigue. The government department recorded a negative growth rate of -1.0 million (previous value: 1.1 million), with the federal government's decline expanding to -1.2 million (previous value: -0.9 million), still reflecting the lagged impact of the BLS previously including personnel receiving layoff payments in employment statistics; state and local governments recorded growth rates of 0.5 million (previous value: 1.0 million) and -0.3 million (previous value: 1.0 million), respectively. Commercial services recorded a decline of -1.4 million (previous value: -1.1 million). The manufacturing sector continued to record a large downward trend of -1.1 million (previous value: -1.5 million).

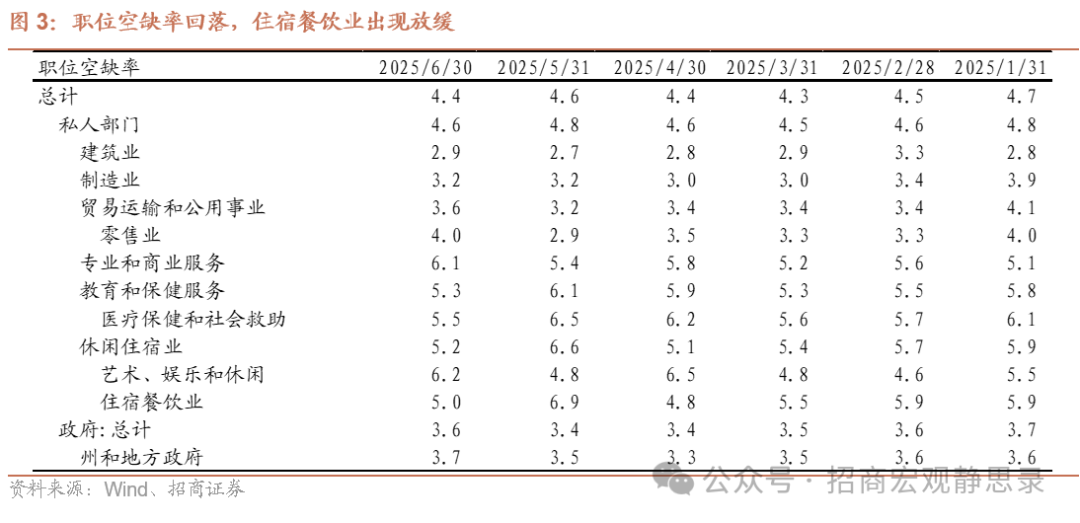

3) From the household survey perspective, demand-side cooling rate exceeded supply-side cooling rate, with the unemployment rate rebounding to 4.2% (previous value: 4.1%).

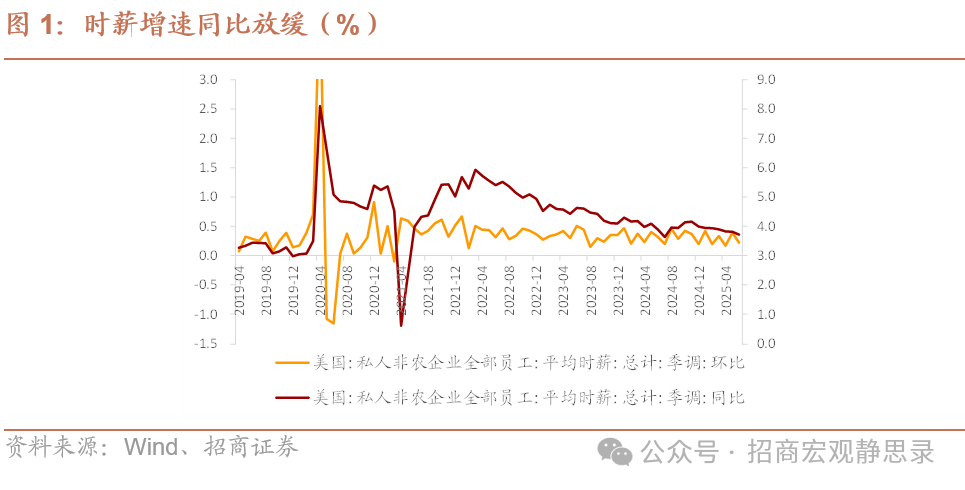

4) Household Survey: Average weekly hours for private sector workers recorded 34.3 hours (previous value: 34.2 hours), still at a weak level.

5) As the non-farm data was lower than expected and the previous value was adjusted downward, the US dollar index reversed its upward momentum and fell sharply to around 98.9 levels. Before the data release, due to the pressure of tariffs on other economies, the US second-quarter GDP growth rate exceeded expectations at 3.0%, and core PCE data were strong, causing the US dollar index to rise to above 100 levels.

CME shows that overseas markets have regressed their expectations for September rate cuts, with policy-sensitive US Treasury bond yields falling by 22.6 basis points to around 3.7% levels, and 10-year yields falling to around 4.2% levels. The three major stock indexes adjusted: the Nasdaq adjusted down 2% to around 20,703 points; the Dow Jones adjusted down 1.4% to around 43,517 points; and the S&P adjusted down 1.5% to around 6,240 points.

Risk Warning: Overseas policy.