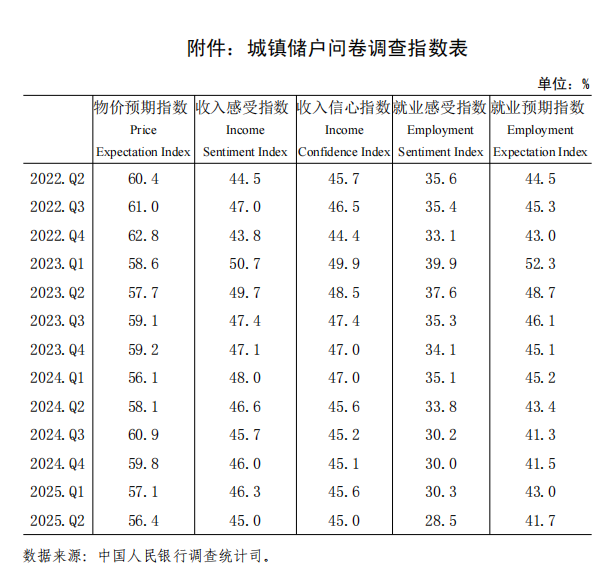

People's Bank Urban Household Survey Report: 2nd Quarter Income Perception Index Drops by 1.2% Compared to Last Quarter

Peking Union Medical College has learned that the People's Bank of China has released the "2025 Second Quarter Urban Household Survey Report". The second-quarter income perception index is 45.0%, down 1.2 percentage points from last quarter. Among them, 10.2% of residents believe their income has "increased", 69.7% believe it has "basically remained unchanged", and 20.1% believe it has "decreased". The income confidence index is 45.0%, down 0.6 percentage points from last quarter.

The second-quarter employment perception index is 28.5%, down 1.8 percentage points from last quarter. Among them, 6.4% of residents believe that "the situation is good and it's easy to get a job", 39.9% believe that "it's general", 53.7% believe that "the situation is severe and it's difficult to get a job" or "uncertain". The employment expectation index is 41.7%, down 1.2 percentage points from last quarter.

In terms of prices and housing prices, for the next season, the price perception index is 56.4%, down 0.7 percentage points from last quarter. Among them, 20.3% of residents expect that "prices will rise", 60.1% expect that "they will remain basically unchanged", 9.0% expect that "prices will fall", and 10.6% are uncertain. For the next season's housing prices, 8.9% of residents expect that "prices will rise", 56.8% expect that "they will remain basically unchanged", 21.7% expect that "prices will fall", and 12.7% are uncertain.

In terms of consumption, savings, and investment intentions, residents who tend to "consume more" account for 23.3%, down 0.5 percentage points from last quarter; those who tend to "save more" account for 63.8%, up 1.5 percentage points from last quarter; and those who tend to "invest more" account for 12.9%, down 1.1 percentage points from last quarter. The top five investment methods preferred by residents are: "non-principal-guaranteed bank wealth management products", "fund trust products", "stocks", "bonds", and "non-consumer type insurance". Residents who choose these five investment methods account for 34.8%, 24.7%, 16.3%, 15.3%, and 9.8% respectively.

When asked about the projects they plan to increase their spending on over the next three months, residents' top five choices are: tourism (32.1%), education (31.9%), medical care and health (29.3%), social culture and entertainment (24.0%), and large-scale consumer goods (21.1%).