Syndicate Rebound + Regulatory Relaxation: Small Investment Banks Sing 2025 IPO Recovery

Zhitong Caijing APP has learned that compared to super-large investment banks such as Morgan Stanley and Goldman Sachs, smaller investment banks like Evercore Inc. and Stifel Financial Corp. have given a very optimistic outlook for the future stock market capitalization in the remaining time of this year. According to reports, these two major investment banks are betting on a significant reduction in market volatility and the White House's relaxation of regulatory measures to stimulate larger-scale equity issuance.

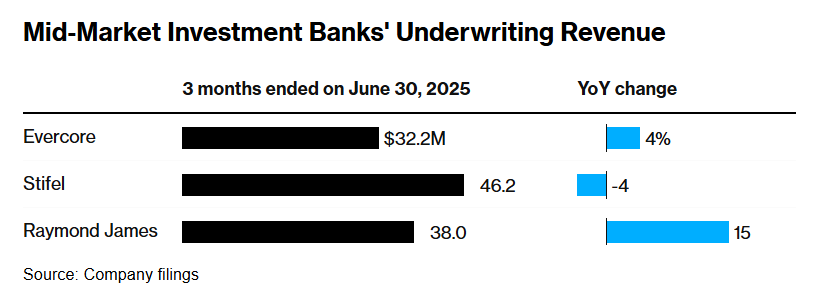

Evercore announced its second-quarter earnings report on Wednesday local time, showing that its stock and bond underwriting fees increased by 4% year-over-year to $3.22 million. "Our stock underwriting business unexpectedly rebounded in May and June, and we expect these positive IPO trends to continue into the second half of the year," said John Weinberg, CEO of Evercore.

In the second quarter, Evercore participated in the IPOs of Chime Financial Inc., Hinge Health Inc., MNTN Inc., and Omada Health Inc. It also executed subsequent financing plans for Birkenstock Holdings Plc and Waystar Holding Corp.

Mid-market investment banking underwriting revenue

At the same time, another mid-sized investment bank Stifel reported a 3.7% year-over-year decrease in its equity financing revenue due to reduced issuance volume, down to $46 million. However, this did not stop CEO Ronald Kruszewski from maintaining an optimistic outlook for the second-half IPO trends.

"We've seen early signs of a broader IPO recovery, and subsequent financings are still driven by private equity, which remains the main driver," said CEO Ronald Kruszewski at the company's earnings call.

In the second quarter, Stifel served as the joint bookrunner for Smartstop Self Storage REIT, Etoro Group Ltd., and Hinge Health's IPOs, and participated in QXO Inc.'s subsequent financing plans, led by CEO Brad Jacobs.

The views of top executives at smaller investment banks are almost identical to those of large investment bank institutions. Morgan Stanley CFO Sharon Yeshaya said that while most of the time from April to May was spent on IPO issuance slowing down, convertible bonds, subsequent financings, and large-scale IPO issuance all picked up in the quarter-end. Goldman Sachs Group's top executives also stated that companies can enter the IPO market relatively freely compared to previous years, but private equity-backed asset listings are still slow.

Goldman Sachs' second-quarter report showed that the company's stock trading department has consecutively broken records for two quarters, setting a new high in transaction revenue on the back of market volatility fueled by US government trade policies. Goldman Sachs' Q2 stock trading revenue reached $430 million, exceeding analysts' expectations by approximately $60 million and increasing 1 billion from the previous quarter's total revenue. The company's overall profit also surged to $370 million (approximately $10.91 per share), up 22% year-over-year and exceeding market expectations.

According to reports, another mid-sized investment bank Raymond James Financial announced its stock underwriting revenue increased unexpectedly by 15% year-over-year. The company's CEO told investors that after the initial disruption caused by unprecedented tariffs policies in early April, market sentiment has greatly improved since Trump's announcement of reducing tariffs on May 13.

"Perhaps we'll be hit with another negative shock tomorrow, who knows? But it seems that the current market IPO sentiment is much more optimistic than in early April." Raymond James CEO Paul Shoukry said at the company's earnings call.