US Labor Market Signals Weak Jobs Growth, Fueling Rate Cut Expectations

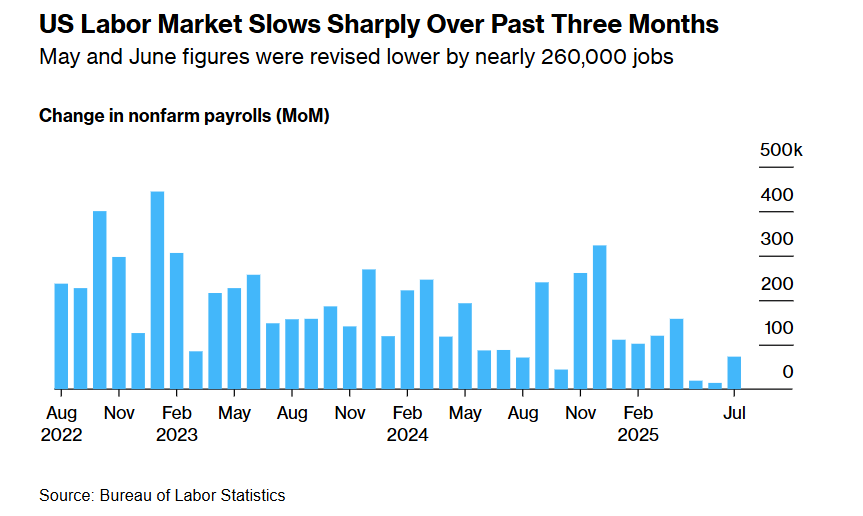

As the US economy faces continued inflationary pressures, tariffs, and uncertain consumer spending, the labor market is showing signs of weakness — latest data shows a sharp slowdown in job growth. For the Federal Reserve, this trend may have opened the door to a rate cut in September.

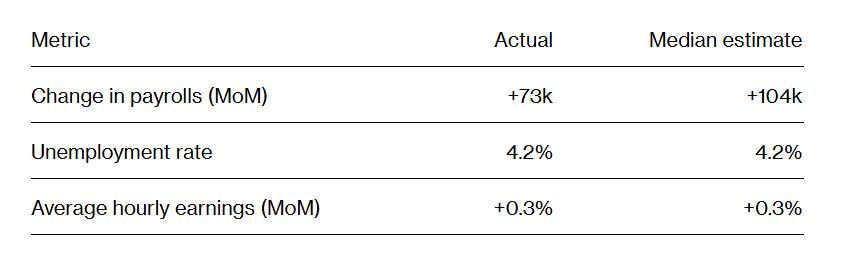

According to the Bureau of Labor Statistics, the US added just 73,000 jobs in July, far below economists' expectations of 11,000. This marked the third consecutive month of subpar job growth, with an average monthly gain of only 3.5 million jobs, the lowest since the pandemic.

The latest labor market data further highlight a growing trend of job market weakness. Not only has job growth slowed down, but the unemployment rate has also ticked up, and applications for unemployment benefits have increased.

According to Nick Timiraos, a prominent Fed watcher, the soft jobs data may have opened the door for a rate cut in September. He noted that the Fed officials are facing a delicate balance between economic growth and inflationary pressures.

CIBC's Ali Jaffery wrote: "Today's report shows a job market that is different from what Powell described earlier this week, which raises the possibility of a rate cut in September."

Nationwide's Kathy Bostjancic said: "The labor market has a big crack, and it's further exacerbating the pressure on the Fed to cut rates and supporting the views of dissenting FOMC members that the committee should cut rates this week."

In "hawkish" tone after the jobs report, Powell was left embarrassed ...