Vulnerable Employment Raises Alarm for Policy Shift! This Week's Earnings Reports Will Test Market Sentiment

Zhitong Caiping APP learned that last Friday, US stocks plummeted from their all-time high, with the reason being the latest employment data revealing that the US labor market is not as stable as expected. The S&P 500 index fell by 2.4% cumulatively, while the NASDAQ composite index dropped by 2.2%, and the Dow Jones Industrial Average fell by 1.2%.

In this week, economic data will be relatively thin, and the market will await the earnings reports of 122 S&P 500 constituents, including Palantir (PLTR.US), Lilly (LLY.US) and Disney (DIS.US) and other industry giants.

Policy Shift Expected to Intensify in September

After the Fed's interest rate decision last week, the market had generally expected that there would be no rate cut in the near future. However, the early morning release of the employment report on Friday completely turned around this expectation.

The latest monthly employment report shows that the number of new jobs added in July was lower than expected, with the unemployment rate rising and the revised data showing that the number of new jobs added was significantly lower than initially reported.

According to the Bureau of Labor Statistics, the downward revision of May and June's employment reports "far exceeded normal levels", with the revised data showing that the economy reduced by over 25,000 new jobs. In May, the number of new jobs added fell from 14.4 million to 1.9 million, while in June, it was reduced from initially reported 14.7 million to just 1.4 million.

Economic analysts and market pricing believe that Friday's report may change the overall economic narrative and the future policy direction of the Fed. According to CME FedWatch Tool data, after Friday's employment report, the market expected a 83% probability of rate cut in September, up from 38% the day before.

US Bank Securities economist Shruti Mishra wrote in a client report: "Since January this year, our basic expectation is that the Fed will not cut interest rates this year. However, we have always thought that the most likely scenario is that labor market weakness would force the Fed to implement 'passive rate cuts' of at least 25 basis points each meeting. The July employment report's large downward revision has increased the likelihood of this scenario."

The July employment report shows that US economic growth may be slower than initially expected, triggering last Friday's market sell-off.

Winthrop Securities Chief Strategist Steve Sosnick said: "In the end, it is the economy that will dictate whether the stock market will do well or need Fed intervention."

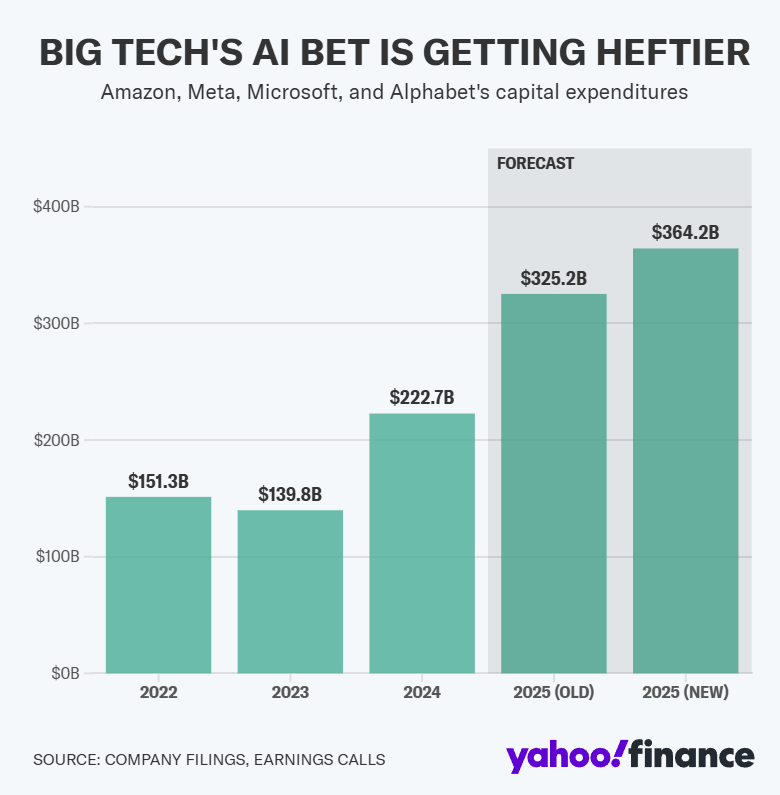

Despite economic growth concerns casting a shadow over the market, the big tech companies' earnings reports showed that AI investment will not stop in the short term, with the market previously looking optimistic. Keane Macro Senior Market Economist James Reilly wrote in a client report: "This Friday's market sell-off may have been 'overdone', as AI will continue to be the key driver of global stock markets."

Reilly pointed out that large tech companies' recent performance has been stronger than the broader market, writing: "These American major 'super-large companies' are collectively continuing to increase their investments. This is one reason why we are optimistic about the technology-intensive board and overall US stock market outlook."

Earnings Season Volatility Intensifies

According to FactSet data, about two-thirds of the S&P 500 index constituents have released their earnings reports, with the earnings growth rate currently at 10.3%, higher than the expected 5% on June 27.

In general, during a period when many companies release their earnings reports, the market tends to be bullish. However, upon closer inspection, individual companies' earnings releases can trigger significant stock price fluctuations. For example, Meta (META.US) surged over 12% after its earnings report exceeded expectations, while Novo Nordisk (NVO.US) plummeted 20% after it lowered its full-year sales forecast.

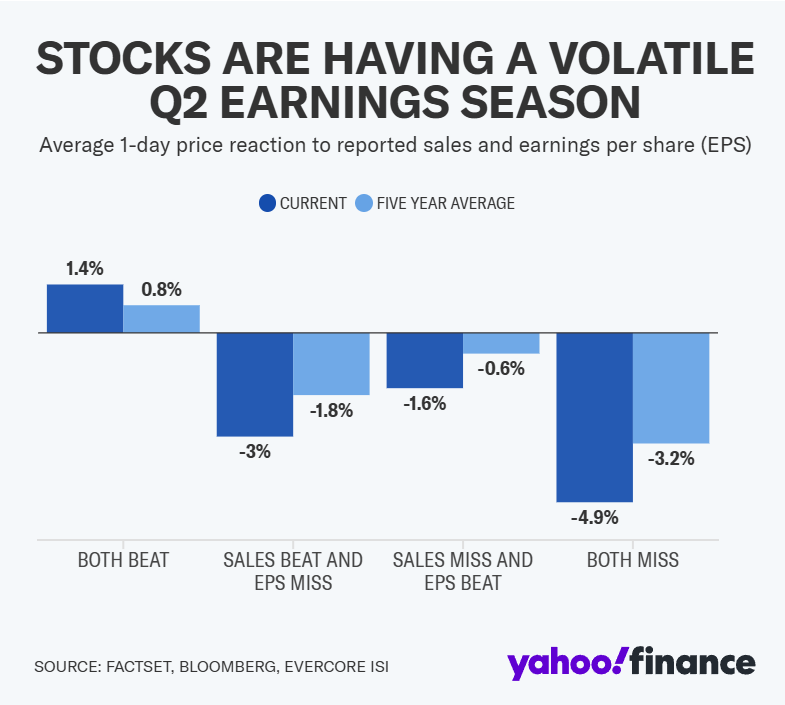

Evercore ISI's Stock, Derivatives and Quantitative Strategy team leader Julian Emanuel pointed out that regardless of whether a company's earnings exceed or fall short of Wall Street expectations, the stock price volatility on the next trading day exceeds the average level.

For example, among S&P 500 index constituents, companies whose earnings did not meet expectations saw their stock prices average a 4.9% decline on the following trading day, exceeding the average 3.2% decline over the past five years.

Emanuel pointed out that since the market is near its all-time high, investors "feel anxious about any imperfection in performance" during this earnings season.