Will Yen Break Through 150 Barrier? Japanese Political Risk Increases, Traders Bet on Yen Depreciation

Zhitong Finance APP learned that over the past three months, the yen's performance has lagged behind all its major competitors. As political risks increase, the yen may further depreciate. Strategists are bearish on this currency trend, expecting Japan's election results to prompt the government to increase spending, while US tariffs policies may still slow down the Bank of Japan's interest rate hike steps. This view is consistent with options traders' expectations, who are preparing to bet on the yen's further depreciation.

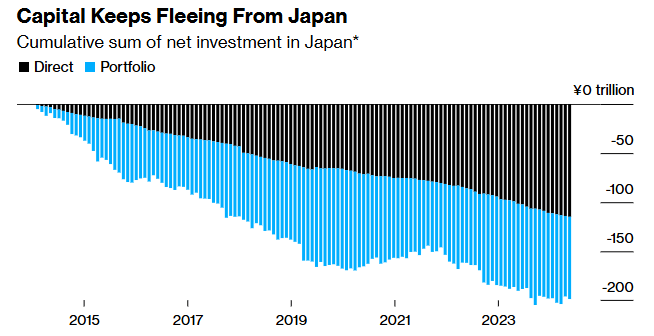

In the July 20 Senate election, the ruling coalition led by the Liberal Democratic Party and Komeito suffered a crushing defeat, which has become a key factor influencing Japan's currency trend. Analysts warn that Prime Minister Fumio Kishida may take populist measures to consolidate his support rate, which could lead to increased government spending and potentially trigger capital outflows, putting pressure on the yen.

Mitsubishi UFJ Bank's global market research head Derek Halpenny said: "Although the election is over, there are still some political risks that could make the prime minister resign, and the Liberal Democratic Party will hold leadership elections in September. The demand for dollar-yen put options may also reflect this expectation that the Bank of Japan governor Haruhiko Kuroda will not issue a rate hike signal soon, given the downward pressure on short-term economic growth and inflation."

The value of dollar-yen put options will increase as the currency appreciates. These options can be used to hedge against yen depreciation.

According to data released by the US Securities and Exchange Commission on July 28, dollar-yen put option trading shows that bets on a rising currency far outnumber those on a falling one, with a ratio of about 4:1.

This pessimistic sentiment is contrasted with the views of asset management institutions. The Commodity Futures Trading Commission's data shows that these institutions increased their net long positions in yen by 7% as of July 22, while leveraged funds reduced their bets on this currency.

Since April, the yen has depreciated about 6% against the US dollar to around 148.27 per dollar. The decline is partly due to concerns over Japan's general election. Those betting on yen depreciation expect Fumio Kishida to adopt populist measures to boost his support rate and reduce taxes by a large margin in response to opposition demands.

Analysts at Barclays Securities wrote in a report: "Regardless of the final political outcome, fiscal policy may take a more expansionary path. If such policies are implemented, the dollar-yen exchange rate could break through 150 because its sensitivity to long-term price changes is relatively high."

The further depreciation of the yen may encourage people to adopt a popular "carry trade" strategy, which involves borrowing at low interest rates in yen and investing in higher-yielding currencies.

A senior FX options trader at Nomura International's London branch, Sagar Sambrani, said: "The reasons for dollar-yen appreciation are multiple - market expectations of dollar weakness seem a bit overdone, while dollar-yen long positions provided excellent hedging opportunities during the quiet summer period."

However, some people are more optimistic about the yen's outlook, citing only that they believe dollar strength is temporary. According to Ayako Sera, a market strategist at Sumitomo Mitsui Trust Bank, although Japan's proposed US investment fund may trigger capital outflows, this year's dollar-yen exchange rate could rise to around 142-143 due to the Federal Reserve's interest rate cuts.

The Bank of Japan will make its policy decision on Thursday, which may influence the short-term trend of the yen. Investors will carefully study Governor Haruhiko Kuroda's remarks to try to gauge when the next interest rate hike will take place, with some reports suggesting that officials believe there is a 74% chance of a rate hike before year-end.

Overnight index swaps show that the Bank of Japan has a 74% probability of raising rates before year-end, up from 59% last week. Previously, an agreement was reached to impose a 15% tariff on Japanese goods by the US. Some strategists believe that although this tariff rate is lower than the originally threatened 25%, it is still higher than at the beginning of the year and will have an impact on the economy.

Bart Wakabayashi, manager of the US Bank's Japan branch, said: "The Bank of Japan needs time to observe the actual impact of these tariffs, so I think they will temporarily hold off on taking action. The yen currently has no particularly favorable factors." He also noted that the yen may depreciate below 150 this year.