AI Supply Chain Tracking: CoWoS Capacity, Capital Expenditure, H20 Shipments Soar AI Demand Sees Accelerated Release

Zhitong Caijing APP has learned that Morgan Stanley has published its latest research report, indicating that artificial intelligence (AI) demand continues to be strong, from cloud service providers' capital expenditures to chip manufacturers' capacity layouts, with the entire industry chain presenting an accelerated expansion trend. Under this backdrop, the firm recommends "adding" Nvidia (NVDA.US), Broadcom (AVGO.US), Taiwan Semiconductor Manufacturing Company (TSM.US), Samsung (SSNLF.US), Alchip, MediaTek, Aspeed, and ATEYY.US) and Kyec.

AI Demand Continues to Explode, Tech Giants Increase Investment

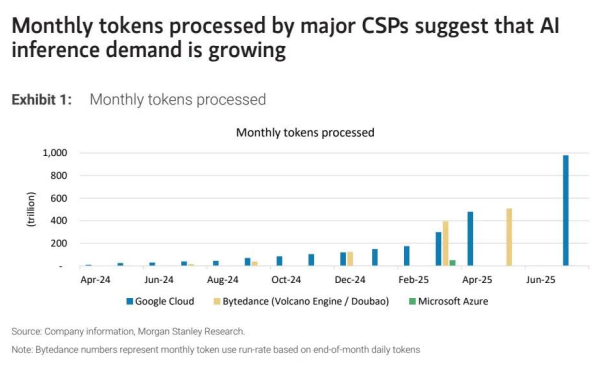

The report notes that as the core indicator of AI demand, cloud service providers' capital expenditures and token processing capacity have performed outstandingly. Currently, Google (GOOGL.US) has increased its capital expenditure budget for 2025 from $750 billion to $850 billion, mainly for server investments and data center construction, and is expected to further accelerate investment in 2026. Notably, Google's monthly token processing volume has surged from 480 million in May to 980 million, highlighting the rapid growth of AI reasoning demand. Morgan Stanley thus maintains its "attractive" rating for the US and Greater China semiconductor industry, believing that AI demand resilience will continue to support industry growth.

H20 Chip Shipments Restart, China Market Becomes Focus

Morgan Stanley also notes that the previously highly-anticipated H20 chip shipments are expected to resume. Looking at the semiconductor supply chain in Taiwan Province, China, the processing of H20 chips has accelerated, with additional production capacity expected to reach 100 million units. In 2025, the planned production volume for B40 chips remains unchanged at 200 million units. Currently, Tencent (00700) and other Chinese cloud service providers have expressed interest in purchasing H20 chips, but B40 has not received a clear response. Additionally, AMD (AMD.US) is expected to maintain its MI308 chip orders for the China market, with Morgan Stanley forecasting that Taiwan Semiconductor Manufacturing Company's CoWoS-S encapsulation volume will increase from 5,000 units to 6,000 units in 2025.

TSMC CoWoS Capacity Distribution: 2026 Industry Growth Engine

TSMC's 2026 CoWoS encapsulation capacity plan shows that the global cloud AI chip industry will see a 40-50% growth. Specifically, it is expected that Nvidia will receive 51 million units of CoWoS orders in 2026, accounting for approximately 540 million chips, with a year-over-year increase of 31%, including Rubin chips occupying 240 million units; AMD's MI355 and MI400 series chips are expected to account for 8,000 units of production capacity; Broadcom has reserved 14.5 million units of CoWoS orders for Google TPU, Meta (META.US), and OpenAI, with ASE/SPIL also reserving some CoWoS capacity for Google TPU.

AI Supply Chain Extends, Long-term Growth Momentum Sufficiency

Looking at the supply chain as a whole, AI chip-related wafer revenue is expected to reach $145 billion in 2025, with HBM demand approaching twice that of 2024. Morgan Stanley predicts that the US four major cloud service providers (Amazon, Google, Microsoft, and Meta) will generate operating cash flow of $55 billion in 2025, providing solid support for continued AI data center investments, with their AI capital expenditures and EBITDA ratio expected to stabilize at around 50%, depreciation accounting for 10-14% of total expenditure.

Morgan Stanley also emphasizes that the expansion of AI supply chain is not limited to chip and encapsulation, but also includes GPU and ASIC rental prices, enterprise revenue structure, which confirms industry enthusiasm. Nvidia and AMD's data center semiconductor revenue continues to grow, with TSMC expected to increase its AI-related income in 2025 to 25%, up from around 15% in 2024. Overall, the firm believes that TSMC's CoWoS capacity expansion, HBM technology progress, and tech giants' capital expenditure growth will be the main driving force for the industry.