Butuan's Q2 US Stock Holdings: NVIDIA (NVDA.US) Remains Top, First Allocation to Digital Currency Concepts

As of June 30, Butuan's overseas fund "Oriental Harbor Investment Fund" held a total of 13 US stocks with a value of $11.26 billion, equivalent to over RMB 80 billion. This is a significant increase from the previous quarter's holding of $8.68 billion.

The fund's core holdings remain stable, and new concepts have emerged. Butuan's Q2 portfolio allocation in US stocks has been characterized as steady and bold, seeking certainty in the global technology landscape while also responding to future trends.

Technology mainline continues to advance, NVIDIA remains top

From a structural perspective, Butuan's Q2 US stock holdings continue to focus on technology leaders. NVIDIA (NVDA.US) has remained the top holding since 2023, and its core resources have been highlighted in the AI era. Even with short-term price adjustments, NVIDIA's position as a leader in the development of AI-based technologies has not changed.

Google (GOOG.US), which was previously ranked lower, has risen to second place. This portfolio adjustment is closely related to Google's continued investment in AI large models. Unlike NVIDIA, Google's role in the AI ecosystem is more focused on application and platform building, serving as a key link between AI and consumer scenarios and developer ecosystems.

Amazon, Microsoft, and Meta, old guard technology giants, have also risen in ranks with Google.

In general, this round of allocation remains centered around the theme "AI technology and computational infrastructure." A private equity analyst noted: "Butuan's US stock holdings strategy is not just about industry competition; it's about the main axis of technological evolution — whoever controls the next-generation commercial foundation will be worthy of long-term holding."

Butuan's overseas fund Q2 US stock holdings as of June 30 (data source: Fund management company, private equity data compilation)

In addition to the mainline assets, there has been a marginal expansion in the number of holdings from 10 to 13. This approach maintains the concentration of mainline assets while providing space for new directions. This approach is particularly cautious in complex macroeconomic backgrounds and ensures that the investment portfolio has some diversification risk.

At the same time, Butuan's domestic fund combination also reflects a consistent layout tendency. According to private equity data, the domestic product has concentrated on 7 ETF funds closely related to US stocks, with a total value of approximately RMB 93 million. The top 10 components of these ETFs are highly concentrated in Microsoft, Apple, Google, NVIDIA, Amazon, and other US technology giants, further verifying their cross-platform integrated layout logic.

Butuan's domestic ETF as of December 31, 2024 (data source: Choice, ETF fund report for 2024)

First allocation to Coinbase, signaling outside structure exploration

If NVIDIA and Google are Butuan's "constant" US stock holdings, then Coinbase is more like a strategic experiment. Data shows that the company was newly added to Butuan's portfolio in Q2, with an investment value of approximately $54.7 million.

Coinbase as the largest digital currency exchange platform in the United States covers a range of business areas, including fiat-crypto asset conversion, custody services, blockchain infrastructure development, and developer tool platforms. Its stock price may be volatile, but it has relatively stable commercial models in the context of basic construction in the cryptocurrency industry.

Combining Butuan's consistent emphasis on "investing in companies that change the world" logic, Coinbase's entry can also be seen as an extension of this logic to new technological fields. As Butuan noted at a private meeting in 2025: "The AI era is not a short-term wave; its evolutionary cycle is more like that of major technological revolutions such as electronic hardware, the Internet, and mobile Internet, with a cycle of over 10 years." From this perspective, Coinbase's entry is a strategic extension based on forward-looking predictions, rather than a standalone speculative action.

A private equity expert familiar with Butuan's strategy noted that in the framework of its funds, "investing in companies that change the world" is an important standard. Although Coinbase does not belong to traditional technology hardware or algorithmic companies, as the connecting interface between cryptocurrency assets and mainstream finance, it has a "mode outside extension" imagination.

Private equity performance leader, high-volatility strategy welcome to harvest period

Looking at product performance, Butuan's Q2 portfolio allocation has delivered outstanding results. Private equity data shows that as of July 18, Butuan had 77 products on display, with nearly three-quarters achieving returns exceeding 40% over the past quarter.

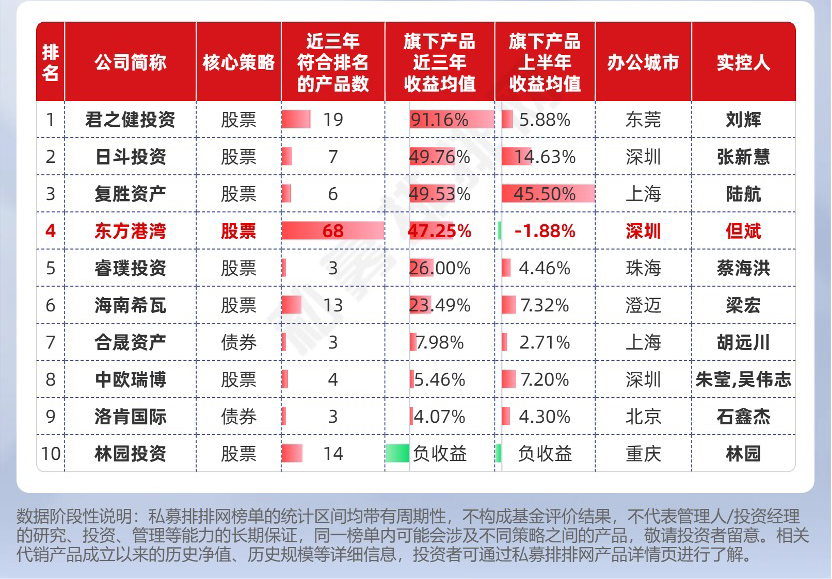

Meanwhile, the core strategy's long-term return ability remains stable. According to private equity statistics, as of June 30, 2025, Butuan's flagship product has achieved an average return of 47.25% over the past three years, ranking fourth in a pool of over RMB 100 billion private equity funds.