NVO-US: A Turning Point? Market Overreaction or GLP-1 Myth Come to an End?

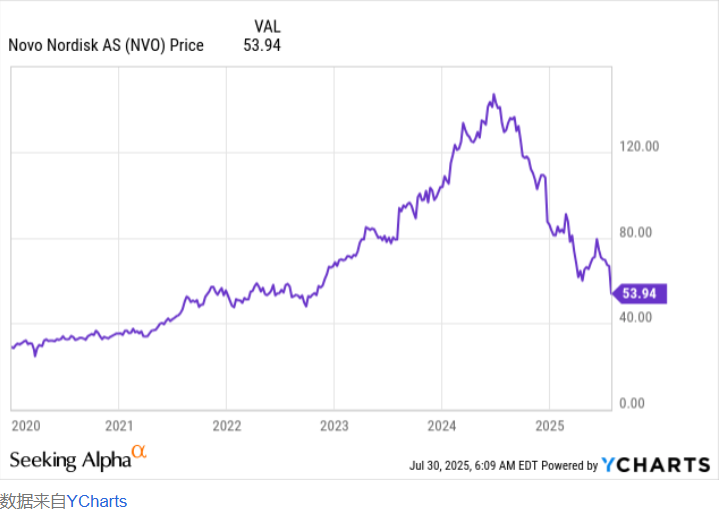

Zhitong Caifu APP has learned that Danish pharmaceutical giant Novo Nordisk (NVO.US) plummeted nearly 30% in recent days, sparking market shockwaves, with its year-to-date decline exceeding 60%. This dramatic fluctuation has sparked investor hot discussion: Is it a market overreaction or is the "Ozempic era" really coming to an end?

Core Event Summary

Novo Nordisk, as the leader of GLP-1 drug revolution, leveraged Somatostatin (the core component of Ozempic and Wegovy) to expand from diabetes treatment to global obesity trends, once becoming one of the world's most profitable pharmaceutical companies. However, yesterday the company unexpectedly lowered its full-year performance forecast: sales growth rate decreased from 13% to 21% to 8% to 14%, and operating profit growth rate decreased from 16% to 24% to 10% to 16%. This adjustment directly hit stock prices, sparking concerns about a decrease in demand for "weight-loss magic pills".

At the same time, the company announced the change of CEO. The current CEO, Lars Fruergaard Jørgensen, resigned due to "share price performance pressure", and Maziar Mike Doustdar, with over 30 years of experience in international operations, took office. This development sparked divergence among investors: supporters believe that the new CEO has deep institutional experience and can stabilize the situation; skeptics argue that, faced with challenges from competitors like Lilly (LLY.US), Novo Nordisk needs a new face with American market experience.

Fatigue is the current most direct challenge

GLP-1 drugs were initially used for type 2 diabetes treatment and later became popular due to their weight-loss effects, but real-world problems have gradually emerged: the need for long-term injections, high costs, and limited insurance coverage for non-diabetic applications.

For example, Ozempic's monthly cost is around $1,000, while Wegovy is even higher, even with insurance coverage. This has forced some patients to switch to composite GLP-1 drugs, although their therapeutic effects may be discounted but at a lower price. For instance, Hims & Hers, a remote healthcare platform, has started selling similar products, and Novo Nordisk, despite terminating the partnership for "violating composite" issues, still cannot block demand leakage.

Competitive pressure is also unwavering

Lilly's Zepbound has shown superior performance in clinical trials, with an average weight loss of 20.2% over 72 weeks compared to Wegovy's 13.7%. Although Novo Nordisk is testing higher doses (7.2mg) of Somatostatin (currently approved at a dose of 2.4mg), early data shows that the reduction in body fat can reach 21%, but this program is still in the research stage.

Additionally, Sin Dare Biopharmaceutical Co., Ltd. has obtained approval in China for its Maziduo (GLP-1/GlucaGon-like receptor agonist), which may not be as effective (14.8%) but can reduce liver fat and is attractive to Chinese patients with liver disease, accounting for about 30% of the population.

The market has returned from "innovation frenzy" to "commercial reality"

From a valuation perspective, although the stock price has dropped by 60%, Novo Nordisk's current expected P/E ratio is around 17, its enterprise value-to-sales ratio exceeds 6, and its PEG ratio is approximately 1.2, which may not be low but also difficult to estimate.

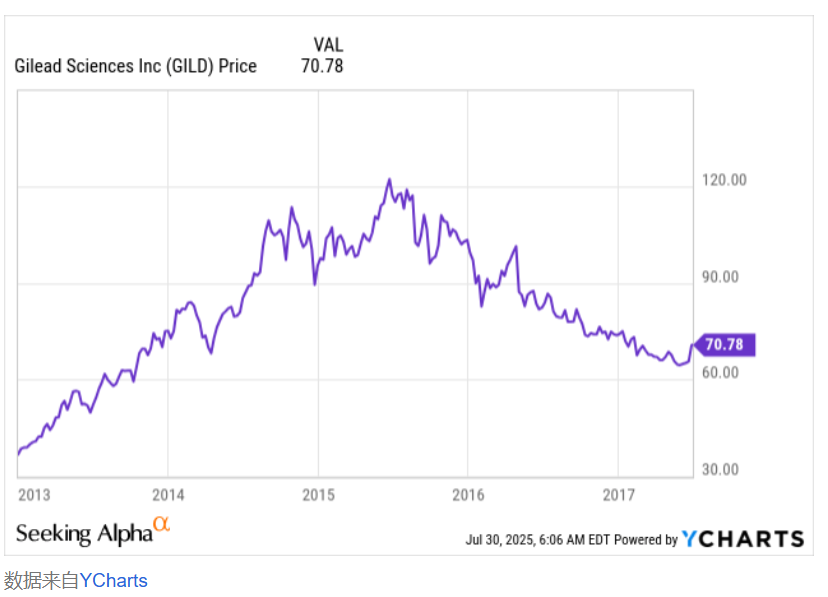

Historical experience shows that pharmaceutical companies' "blockbuster drug cycles" often accompany significant stock price fluctuations: GILD (GILD.US) soared in 2013 due to Sovaldi, then plummeted; Moderna (MRNA.US) saw its vaccine redouble and eventually return to pre-epidemic levels; and Biogen (BIIB.US) experienced a similar fluctuation after approving its Alzheimer's disease drug. These cases demonstrate that stock prices need to re-adapt to growth rates and competitive pressures.

Excluding company-specific factors, macro environment also exerts pressure. The United States may impose a 15% tariff on EU pharmaceutical products, directly impacting Novo Nordisk's profitability in the US (its largest market); and changes to healthcare policies (such as expanding coverage or limiting use) will also deeply affect demand structures.

Can Novo Nordisk Turn the Tide?

Possible turning points include: approval and verification of 7.2mg Wegovy, insurance companies expanding coverage, regulatory tightening of composite drug use, new CEO through cost control or market expansion to revitalize growth, and rapid penetration into emerging markets (such as India and Latin America). However, all these require time, and the results are uncertain.

Conclusion

Novo Nordisk may not "crash and burn", but the myth of Ozempic has ended. This company, once reliant on a single blockbuster drug to revolutionize the market, is now facing the pain of transforming from an "innovation star" to a "regular pharmaceutical enterprise".

The future stock price will depend on whether it can create differentiated value through new dosage forms, market expansion, or innovative platforms. For investors, this requires patience and precise judgment about when the next turning point will arrive in the biotech sector.